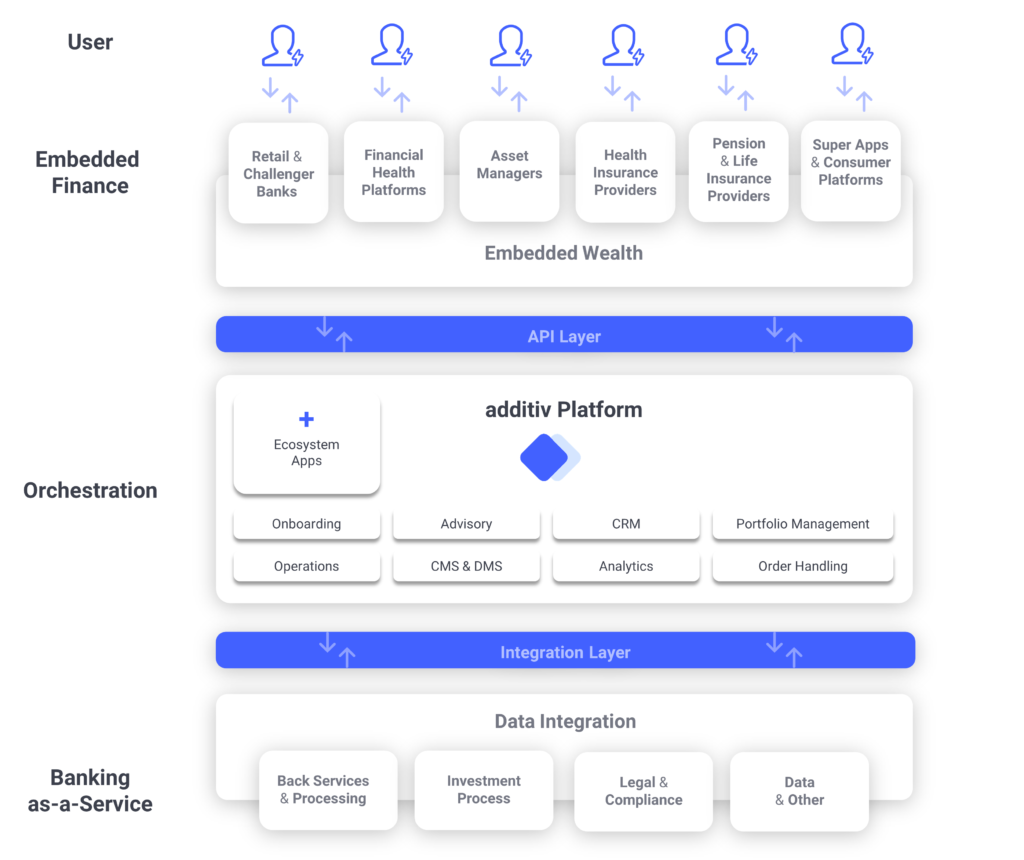

Embedded finance: wealth use-cases fulfilling a prophecy

Sponsored by additivA focus on embedded finance is emerging – changing the dynamics of wealth management - with additiv at its core.

We’ve come a long way since Bill Gates pointed out that “banking is necessary – banks are not” back in 1994. But only now are we seeing banking product dispersion being realised – through embedded finance. However, to date this tends to relate predominantly to payments and loans. Wealth solutions have largely been ignored – but this is changing. A focus on embedded wealth is emerging – disrupting the dynamics of wealth management – with wealth management platform additiv at its core.

The embedded wealth opportunity and use cases

Spotting the opportunity to increase customer convenience, many successful consumer-driven platforms have embedded financial services into their offering, such as payments within Uber or point-of-sale lending at H&M. They provide consumers with relevant financial services, at the time they need them, over the right channel, and tailored to their context.

Embedded finance allows firms to grow their addressable market. Last year Bain Capital Ventures highlighted that, in the US alone, embedded finance represents a $3.6 trillion[1] opportunity.

At additiv, our market conversations indicate that the opportunity for embedding wealth services lies initially in six particular use cases:

- Retail and challenger banks: a proportion of existing customers have large cash balances but for various reasons do not diversify out of low- or zero-yielding savings accounts. By embedding third-party investments, customers access these value-added services with minimal friction, improving banks’ income streams while lowering churn risk. Since retail bank PostFinance introduced own-labelled investment services to its retail customers last year, it has added nearly $34.5 million a month in assets under management. And in the UK challenger Starling Bank has already launched wealth services (via Wealthsimple).

- Financial health platforms: most of these platforms, such as Gusto (US) or Neyber (UK), initially help employees access their wages before payday. And almost all have added, or plan to add, savings services, to help employees’ financial health. Adding investment services is a natural step; Goldman Sachs and Apple recently collaborated to offer financial healthy choices.

- Asset managers: with asset managers focused on investment products and asset growth, embedding their capabilities into wealth services makes perfect sense. This opportunity was recently recognised by Vanguard and Ant Financial Services Group in a joint venture. By accessing Vanguard’s automated service, individual Chinese investors, with at least ¥800 ($113) to place in mutual funds, can now access Ant Financial’s wealth platform.

- Health insurance providers: as a channel that almost all adults use frequently to upload medical bills, make and claim payments, there is already space to embed other services. In addition, most health insurance premium calculation data can be reused to help individuals make smarter decisions about their investments, removing friction from upsales.

- Pension and life insurance providers: according to Citibank, the 20 largest OECD countries alone have a $78 trillion shortfall in funding pay-as-you-go and defined-benefit public pensions. Retirement ages are set to increase, and by offering wealth products through pension and life-insurance providers, consumers can add contributions easily and gain oversight to make financial decisions.

- Super apps and consumer platforms: these aim to be single apps helping people manage their digital lives. Apps such as WeChat in China and Tinkoff in Russia amalgamate dozens of digital services, from peer-to-peer payments through to ride-hailing, driving convenience and customer engagement. As a result, billions of users spend hours on these apps daily, leaving a trail of data that improve them to better match the users to other useful services. As a result the app’s footprint increases over time to incluce wealth services, which many have launched or embedded already.

Ensuring financial institutions don’t become utilities

“We’re very conscious around not being the dumb utility… not giving away the client-customer ownership that’s there.” - Michael Corbat, former CEO of Citigroup, on the Google deal

If wealth providers do not expand their reach and value, they risk missing the consumer opportunity. Embedding their services into third-party distribution channels allows them to grow or shift their customer base with lower acquisition costs, but also to capture network effects. It switches them from defensive to offensive mode.

Embedded wealth: an end-to-end approach with additiv at the core

At additiv, our trusted bank and partner ecosystem can now offer embedded finance and banking-as-a-service (BaaS). BaaS lets banks open up their APIs to third parties to offer embedded finance. We provide the infrastructure that connects a bank’s wealth services with the brands it wants to embed into context-relevant user journeys. For example, our partnership with Bricknode enables companies to embed brokerage-as-a-service.

"The ability of wealth management to effectively integrate platform and ecosystem strategies will serve as a powerful catalyst for the leaders of tomorrow" - Michael Stemmle, CEO at additiv

additiv customers recognise that embedded finance is the future, and 27 years on Bill Gates’s vision is finally being realised. However, instead of undermining the need for banks, embedded finance only serves to underline their continued importance in the digital age.

additiv partners with leading companies across the world to help them capitalize on the possibilities of digital wealth and investment management. Their DFS® omnichannel orchestration platform supports wealth managers looking for best-in-class Software-as-a-Service (SaaS) to deliver better engagement at greater scale. additiv also enables financial institutions to access new distribution channels through a Banking-as-a-Service (BaaS) model, as well as allowing banking and non-banking providers to embed wealth services into their proposition. Find out more at www.additiv.com

by Christine Schmid, Head Strategy, additiv

[1] The $3.6 Trillion Embedded Finance Opportunity – Rebank (bankingthefuture.com)

Business Reporter Team

Most Viewed

23-29 Hendon Lane, London, N3 1RT

23-29 Hendon Lane, London, N3 1RT

020 8349 4363

© 2024, Lyonsdown Limited. Business Reporter® is a registered trademark of Lyonsdown Ltd. VAT registration number: 830519543

Join the Business Reporter community today and get access to all our newsletters, and our full library of talk show episodes

Join the Business Reporter community today and get access to all our newsletters, and our full library of talk show episodes