Blockchain: threat or opportunity for the future of insurance?

Could blockchain technology bring a simpler, more efficient way to provide, buy and consume insurance?

Looking at the global market for blockchain-based insurance, the figures don’t seem particularly impressive. In fact, research by Markets and Markets expects it to reach just £1.39 billion by 2025. A paltry sum compared with the anticipated value of the global insurance industry, which Swiss Re Institute expects to top $7 trillion in 2022.

But the compound annual growth rate (CAGR) and the figures tell a different story. The growth in traditional insurance is estimated in the low-to-middle single digits, whereas blockchain-based insurance has a CAGR of almost 85 per cent. In fact, Gartner estimates blockchain will top $3.1 trillion in new business value by 2030, which represents a huge opportunity for insurance companies and their InsureTech vendors.

It’s time for change

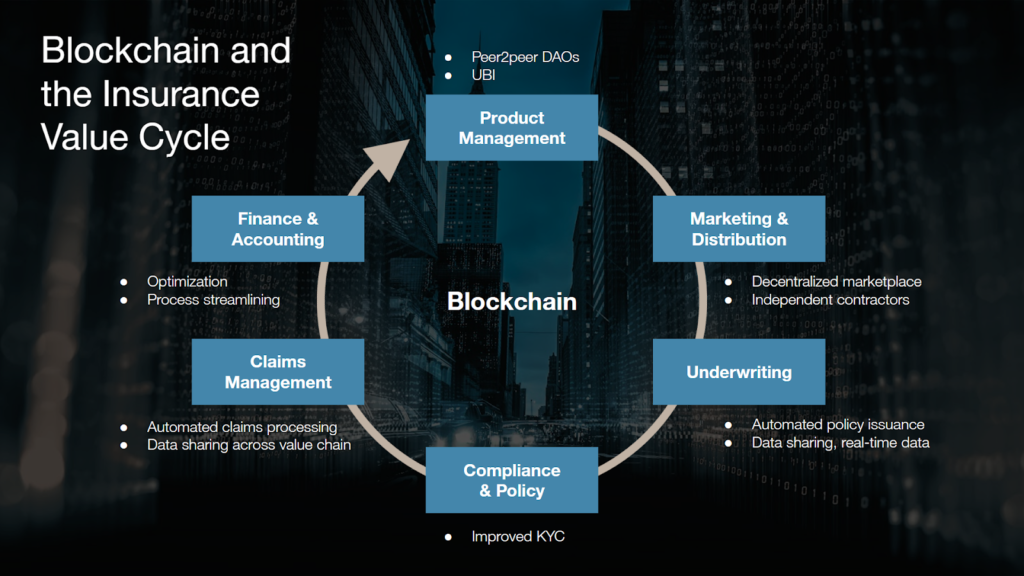

As the industry has grown and flourished, so has it fragmented and atomised, with insurers at one end, claims processors at the other – and reinsurers, managing general agents and brokers in between – all consuming a slice of the pie.

It is in this environment that inefficient exchange of information has also flourished, as multiple parties with different priorities communicate with each other using different systems and processes – to the point where the industry wastes a lot of time, money and resources just maintaining a “complex ecosystem”.

Blockchain can help overcome many of these challenges.

Simplifying complexity

Blockchain’s decentralised quality means it can simplify, expand and accelerate information exchange, while ensuring anyone on any machine, software or system can access the blockchain. This is made even more powerful by ensuring only authenticated, approved users can write data to the blockchain. Moreover, blockchains are protected by consensus protocols, which reduce the likelihood of fraud and malfeasance.

Automating the claims process

Blockchain also can help do away with manual claims processing and reviewing with smart contracts. For example, insurer and insured create a digital agreement (a smart contract) that says every time the latter drives their car, they’re insured up to, say, $5 million, with a $500 excess. And through the use of “oracles”, which connect blockchains to external systems, predetermined conditions can be fed into the blockchain, activating a smart contract based on real data from the outside world.

In fact, Lemonade has built its entire business case on the fact that the vast majority of claims can be processed nearly instantaneously.

Dynamic insurance or usage-based insurance

Dynamic insurance made a big impact during the Covid-19 outbreak, with many car insurance users speaking out against paying a yearly premium when they were unable to drive. Since then, however, usage-based insurance has skyrocketed, affecting various fields. But most interesting is the use of external real-world data to calculate premiums.

Today the technology exists to tell if a driver is drunk behind the wheel, speeding, running red lights or driving without due care and attention. Link all this data together and you can create dynamic products that charge people premiums based on their risk in real-time, rather than on “average”. This would certainly make car insurance fairer and cheaper, and limit low-risk drivers footing the bill for “boy racers”.

The insurance industry is already moving towards a pay-per-use model. With the rise of car clubs and fractional ownership, paying for car insurance by the hour or the day is now commonplace. The trick for insurers will be to package this into a smart contract that’s automated, transparent and ID-verified.

A picture of health

Similarly, health insurers could take a comparable approach using real-time health data from wearable apps such as Fitbit and Apple Watch to adjust premiums by the hour, day or week. Again, technology exists to achieve this but using the blockchain to record and feed all this personal data would allow insurers to link it easily and directly to a specific individual.

Added protection

You can also eliminate policyholders’ concerns around data security by using zero-knowledge proof (ZKP), so individuals have complete control over who accesses, shares, or uses their personal data. Ultimately, it’s about creating tailored, equitable and best-value insurance to meet an individual’s specific lifestyle needs and real-life risk profile, not one based on the average.

Peer-to-peer insurance

On the downside, blockchain, for all intents and purposes, could also democratise insurance. It allows groups to pool their premiums, self-organise and self-administer their own insurance against a certain risk. Similar to peer-to-peer lending, and other DAOs, peer-to-peer insurance would allow a group of people to effectively set up their own insurance firm. Each pool member has a say over when insurance is or isn’t paid out, and smart contracts could go a long way in making the criteria for pay out simple, removing the need for any intermediaries.

There’s also the benefit of full transparency, including on fees, from the claim (when the smart contract is triggered) to payment. This makes the whole process smoother and faster as all the data, documentation and verification has been done already during the process.

Instant finality, compliance ready

In insurance, it is important transactions take place and are recognised in real-time. Recording data two days later won’t cut it. Any blockchain solution has to offer instant finality, so that transactions are recognised, finalised and executed simultaneously.

Insurance is also highly regulated, and insurers can’t insure without knowing who a counter-party is, where their money’s coming from and where it’s being sent. In fact, KYC non-compliance can result in huge fines. So having an integrated ID layer at the protocol level is a must when it comes to the highest levels of security, transparency, legal enforceability and the inevitable regulatory compliance.

Last word

Imagine a world in the not-too-distant future where an individual’s digital identity is controlled via the blockchain. For the insured, it means having complete control over their information and who gets to see, use or share it (whether the actual or ZKP information). For the insurer, it means the ability to tailor insurance based on countless off-chain data sets in real-time to make premiums more attractive to certain risk profiles. But perhaps more importantly, it’s about simplifying and automating insurance, streamlining processes and ensuring people pay premiums that reflect their real-life exposure to specific risks. All part and parcel of today’s empowered consumer.

Concordium’s decentralised layer-1 blockchain technology offers unrivalled security, privacy, transparency and control. It is the only layer-1 on the market with an ID framework which ensures accountability, responsibility and certainty in an uncertain world. Alongside our Reg DeFi Lab we understand that the DeFi space will continue to evolve and gain traction with enterprise and institutional clients. That is why we are partnering with start-ups and tech giants alike, looking to take advantage of blockchain technology. Visit Concordium to find out more.

Business Reporter Team

Most Viewed

Winston House, 3rd Floor, Units 306-309, 2-4 Dollis Park, London, N3 1HF

23-29 Hendon Lane, London, N3 1RT

020 8349 4363

© 2024, Lyonsdown Limited. Business Reporter® is a registered trademark of Lyonsdown Ltd. VAT registration number: 830519543