How generative AI is shaping the future of finance

Sponsored by MiquidoAccording to forecasts, advances in generative AI could automate up to 50 per cent of current job tasks between 2030 and 2060.

It is predicted that in the banking, financial services and insurance sectors (BFSI), generative AI (GenAI) has the potential to increase labour productivity by 0.1 to 0.6 per cent per year until 2040. This could add between $200 billion and $340 billion in value to the industry.

Understanding the value of GenAI for the BFSI sector

So, how can financial organizations benefit from GenAI?

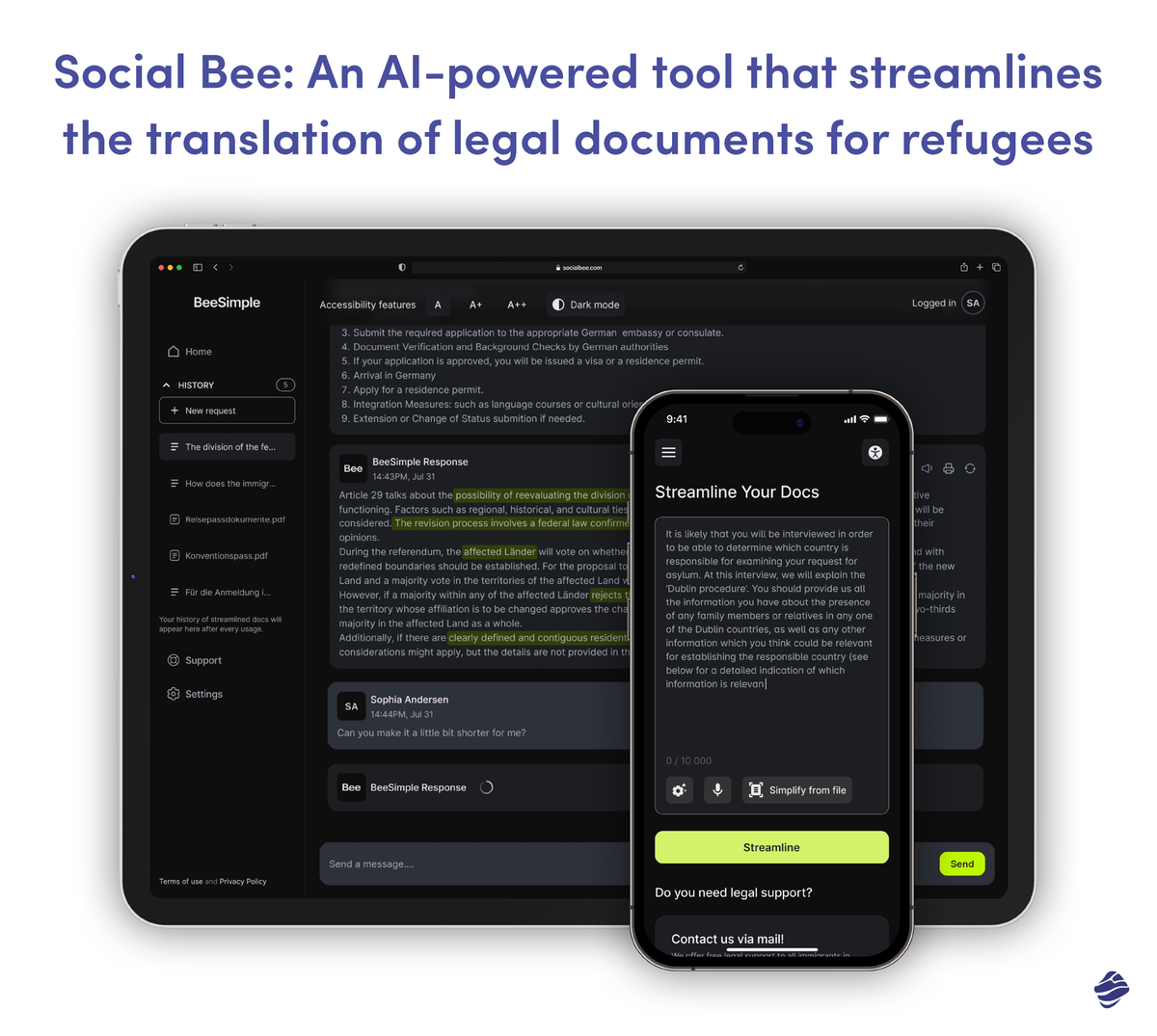

1. Document analysis and processing

Analytical workflows tailored to your needs

2. Customer service and customer support

Inclusive customer service

3. Internal processes and decision-making

AI affects the efficiency of the entire organisation

4. Cyber-security

Key considerations for GenAI deployment

AI is not a silver bullet, but rather a tool that requires careful and responsible use, especially in the fintech and banking industries. In this article, we have outlined some of the applications of AI that are currently safe and provide expected benefits such as cost-savings and increased operational efficiency.

Hands-on experience in commercial AI projects

AI can be a fast track to high ROI

by Jerzy Biernacki, Chief AI Officer, Miquido

Business Reporter Team

Most Viewed

Winston House, 3rd Floor, Units 306-309, 2-4 Dollis Park, London, N3 1HF

23-29 Hendon Lane, London, N3 1RT

020 8349 4363

© 2025, Lyonsdown Limited. Business Reporter® is a registered trademark of Lyonsdown Ltd. VAT registration number: 830519543