Making insurance more accessible and appealing by partnering with brands: an introduction to embedded insurance

In the past couple of years, embedded insurance has become a popular concept in the insurance industry – and also with non-insurance brands. Venture capital firms have invested a huge amount of money in embedded insurance companies ($1.7 billion invested in 2021), and we have been witnessing an explosion of new distribution partnerships between insurers and brands willing to offer insurance to their customers.

The rise of its popularity has, at the same time, raised concerns about the provision of insurance from non-professional intermediaries, and scepticism about the real potential of embedded insurance. In this article, I take a fresh look at the data and insights I have come across while doing my job of running the Open and Embedded Insurance Observatory, shine a light on embedded insurance, and explain – with the support of data – why I decided to make embedded insurance the core of my work

Our society and businesses today are exposed to an increasing set of environmental, technological, human and business perils. Those exposures, when not properly identified, assessed and treated become risks that pose a threat to the stability of our society and our economy. This fragility is commonly associated with the “protection gap”, a concept introduced by the insurance industry to identify the gap between the amount of insurance that is economically beneficial and the amount of coverage actually purchased. Today, the protection gap is a problem – both in developed and developing economies, and for individuals and businesses (particularly SMEs) alike.

The protection gap is caused by factors concerning regulatory infrastructure, and the supply and demand of insurance. At a very high level, the main issues on the supply side are a lack of appetite for certain risks or types of customers, and the incapability of insurers to reach modern customers in the way they expect. On the demand side, the main issues are the lack of trust in the insurance industry, the unsuitability of many existing insurance products, and a tedious user experience. Embedded insurance can help fix these issues, and can help insurers attract customers, encourage them to supply capacity, and increase the willingness of customers to purchase insurance.

At the Open and Embedded Insurance Observatory, we define embedded insurance as “partnering with brands to expose insurance products and insurance-powered value propositions within their products and services”. With embedded insurance, we can make insurance products and services more accessible and appealing, by offering them through brands that people and businesses trust, within user experiences that they enjoy, and in contexts where valuable transactional data are created.

Embedded insurance is gaining a top spot in the wider embedded finance market. There are certain business and technological conditions that have given birth to embedded finance and embedded insurance and which are driving their growth: the global availability of the internet (the connectivity framework on which almost all the new technologies and business models introduced in the last 20 years are based) and of mobile (which has made access to the internet and to internet-powered services available anytime and from anywhere); the advancements in big data analytics (the capability to extract value from the data generated by the interactions made possible by the internet and mobile); and APIs, the gateways that make it possible to embed financial and insurance services via the internet and create mobile-powered interactions between brands and their customers.

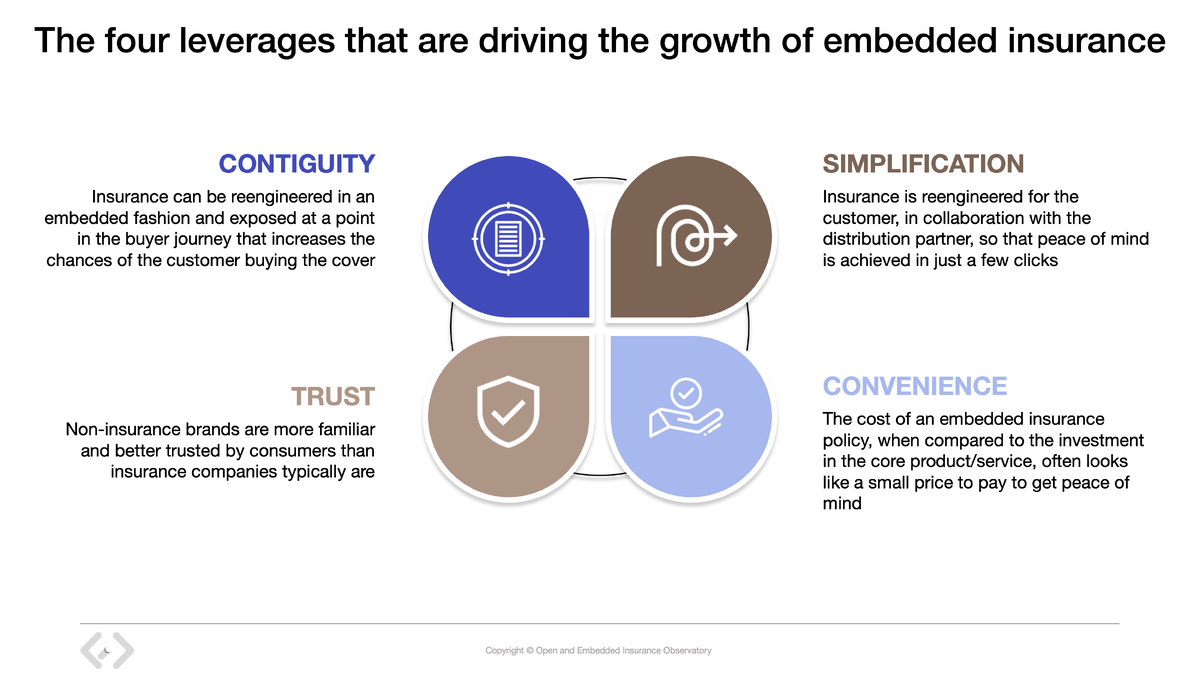

There are four levers that position embedded insurance as a model able to fix a significant part of the issues and rigidities apparent in the current insurance market:

• Contiguity. Insurance can be reengineered in an embedded fashion and exposed at a point in the buyer journey that increases the chances of the customer buying the cover, meaning an exponential increase in conversion rates. In commercial lines, which are traditionally considered “too complex to be embedded”, leading embedded insurance players register attach rates in the range of 30 to 80 per cent.

• Simplification. Insurance is reengineered for the customer, in collaboration with the distribution partner, so that peace of mind is achieved in just a few clicks, as opposed to the purchase of insurance being a tedious process. Caravana, a US-based used car marketplace, in collaboration with the insurtech company Root, reduced the number of clicks required to buy a policy from 24 to three – by leveraging customer data generated by Carvana.

• Trust. Non-insurance brands are more familiar and better trusted by consumers than insurance companies typically are, and as such consumers’ openness to buy insurance from non-insurance brands is steadily increasing. Based on research from insurtech Boost, 73 per cent of US customers have either bought insurance from a non-insurance brand or would be interested in doing so.

• Convenience. The cost of an embedded insurance policy, when compared with the investment in the core product/service, often looks like a small price to pay for peace of mind. Furthermore, leveraging a brand’s existing customer base means customer acquisition costs for the distribution partner are lower than those of traditional insurance distribution models (where there is fierce price competition that often leads to diminished products). This creates additional margins for the distribution partners, which they may decide to use to further reduce the cost of insurance for the end customer – something that would further highlight the true value of the embedded insurance product.

In conclusion, embedded insurance promises to be a game-changer for the insurance industry, but whether and to what extent it will lead to an enlarged insurance market and reduce the protection gap will depend on several factors – including regulatory frameworks, the commitment of the insurance industry and the results achieved by the brands that launch, and have launched, embedded insurance programs.

Over the next two articles, I will cover in more detail the actual and prospective applications of embedded insurance in the SME and retail segments.

By Yuri Poletto, Founder of the Open and Embedded Insurance Observatory

Business Reporter Team

Most Viewed

Winston House, 3rd Floor, Units 306-309, 2-4 Dollis Park, London, N3 1HF

23-29 Hendon Lane, London, N3 1RT

020 8349 4363

© 2025, Lyonsdown Limited. Business Reporter® is a registered trademark of Lyonsdown Ltd. VAT registration number: 830519543