Solving payment fragmentation in Southeast Asia with NomuPay’s all-access pass

Sponsored by NomuPay

Peter Burridge, CEO, NomuPay

When was the last time you purchased something online? Yesterday? Today? Did you literally just click “Buy now” in another browser window?

For many consumers, hitting the “Add to cart” button has replaced a physical run to the store. Nearly 16 per cent of Americans shop online at least once a week, with roughly 2 per cent stating they make daily purchases. But that’s not to say this growing propensity for online shopping is merely a Western obsession. Economists project that key countries in Southeast Asia will experience e-commerce growth in the double-digit percentages through 2025; in places such as Turkey, that forecast is as high as 20 per cent annual growth in the coming years.

Not surprisingly, the attractiveness of these fast-growing e-commerce markets has further resulted in a flurry of foreign expansion efforts as large enterprise businesses and globally focused payment providers try to gain a foothold with local consumers and merchants. There’s just one problem: online payments (including both the inbound acceptance and the outbound disbursement of funds) are different in each market and failure to understand the fragmented nature of the landscape in places such as Southeast Asia and Turkey will greatly limit any organisation’s ability to capture local market share.

Cards won’t cut it

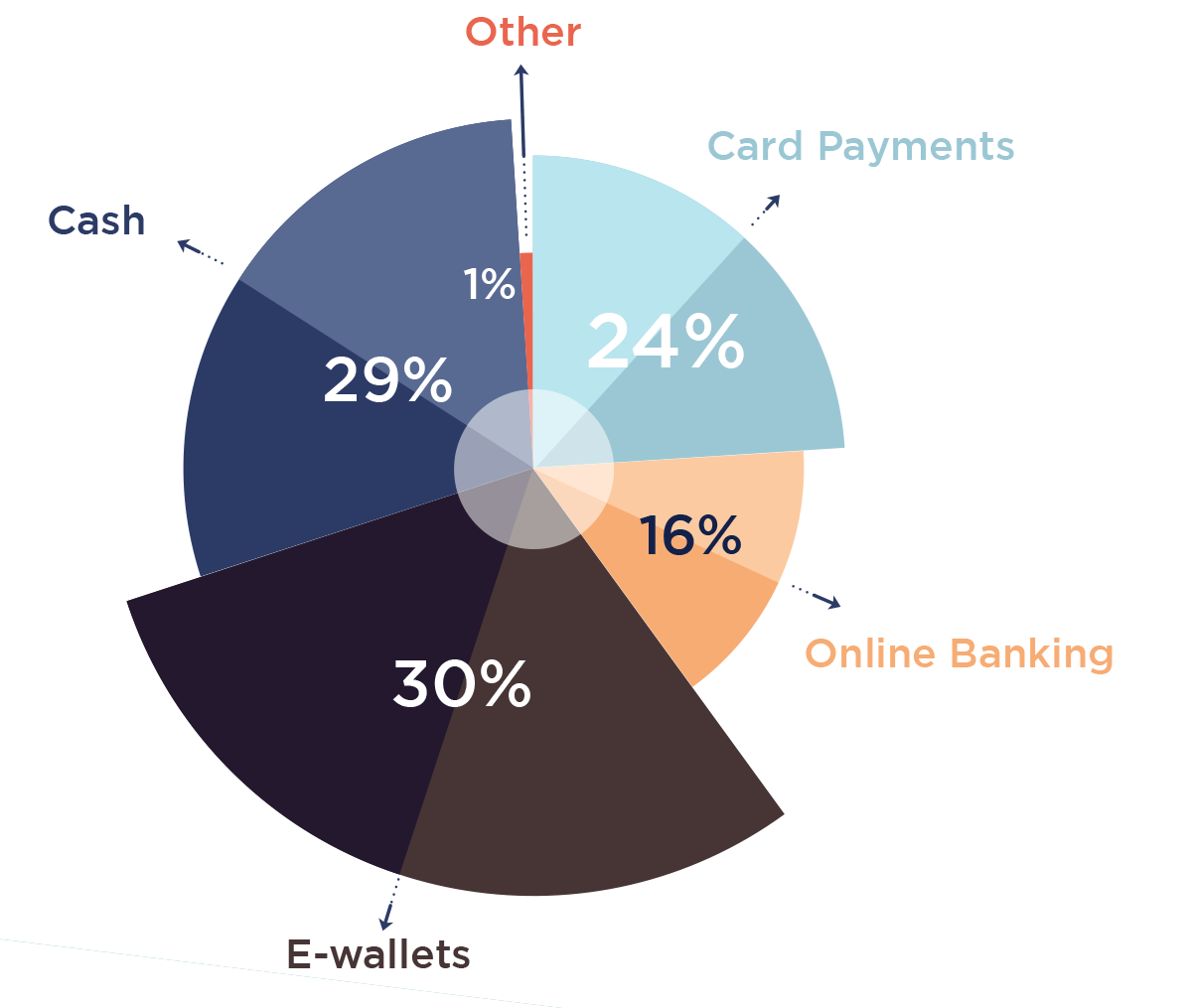

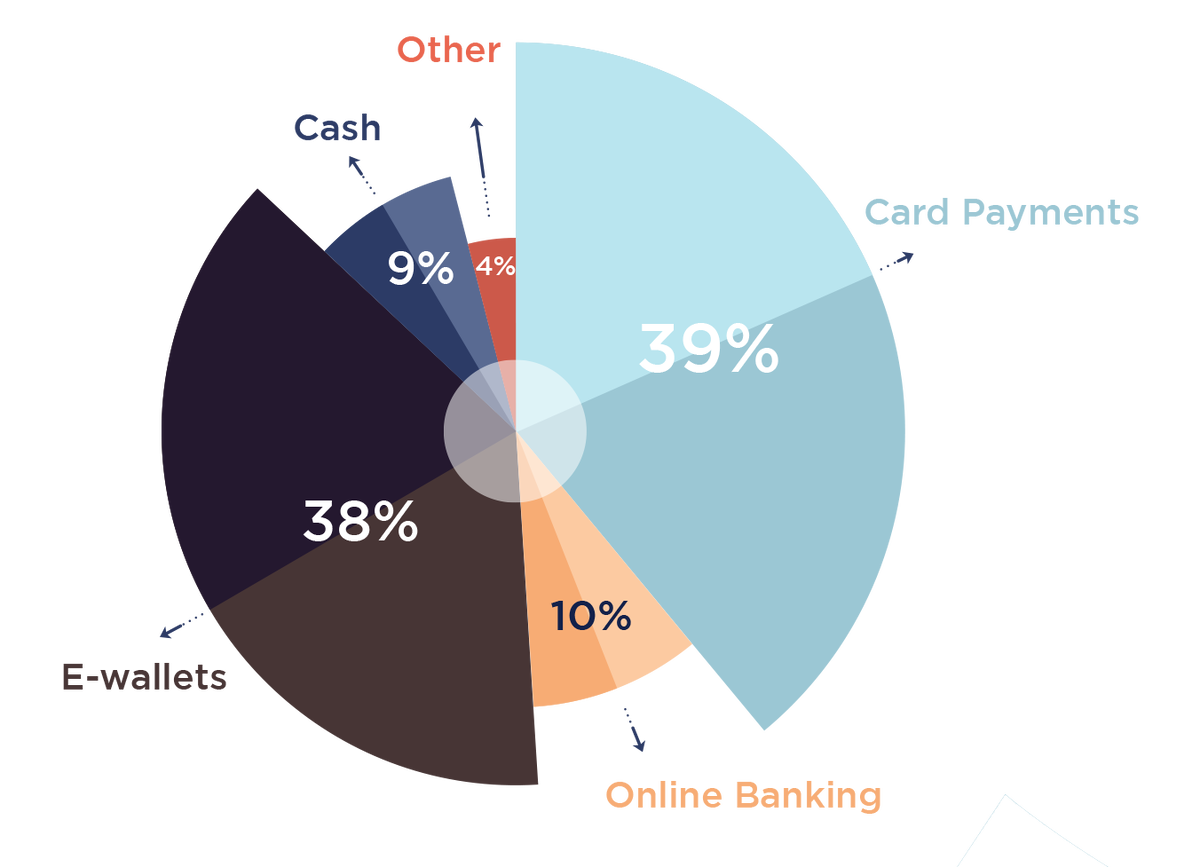

In the US and Europe, it’s common for businesses to build their entire e-commerce strategy around card networks. In Southeast Asia, however, card acceptance isn’t nearly as ubiquitous; in the Philippines, for example, debit and credit cards only account for about 24 per cent of transactions. For many Southeast Asians, local alternative payment methods (APMs) and e-wallets are the preferred purchasing and stored value instrument, and thus become must-have checkout options for any payment provider or e-commerce platform planning to conduct business in the region.

There’s just one problem: there are literally dozens of these APMs and digital wallets on the market. Merchants that want to accept payments and/or send dibursements through these channels will need to either integrate with APM-equipped payment gateways (the likelihood of one provider having all the available methods is very low), or contact each local bank and/or APM partner to individually integrate them into their unique payment stack. This is an extremely heavy lift, even for the most sophisticated of merchants. With numerous integrations comes a multitude of maintenance requirements, lengthy developer buildouts and a myriad of paperwork, contracts and administrative overhead.

To be clear, this isn’t an either/or scenario. Cards should absolutely be a part of your expansion efforts into regions of high e-commerce growth. Card usage in Hong Kong, for instance, remains strong, falling just short of 40 per cent penetration, proving that certain demographics still prefer plastic. Which leads us to the importance of partnering with a payment company that maintains local acquiring infrastructure. While many cross-border payment technologies claim to be able to process card transactions from Southeast Asia and Turkey, very rarely are they processing those transactions in the region.

This is because of strict card scheme requirements that demand both merchants and payment providers maintain a local entity and licensing. Without this, providers are left to process card transactions via cross-border acquiring, a setup that is far less reliable than a truly local implementation. Cross-border processing tends to have higher decline rates and chargebacks as local banks aren’t as familiar with their operations as a local provider. This type of infrastructure can also suffer from high latency and low authorisation rates.

The devil’s in the data

The fragmentation of data is another challenge. This is because the more payment methods you offer, the more varied your corresponding datasets will be. From overarching transaction identifiers to method-specific transaction types and scheme fees, sophisticated e-commerce companies and payment providers depend on detailed transaction data for a wide variety of reconciliation and reporting purposes.

The problem is, not every payment system is committed to exposing all available data to customers in a consolidated manner. Remember earlier, when we mentioned the high probability of having to integrate with multiple gateways and/or dozens of banks or APMs? Each one of those unique integrations will result in a different mix of available payment data. In some cases, it may be accessible by API, in others it may be locked within a reporting scheme.

Either way, efforts must be made to consolidate this information into a useable format, and even then, critical gaps in the data may still exist, jeopardising your ability to provide clear visibility and performance metrics into payments on your platform.

Fix fragmentation with NomuPay’s unified approach

For better or worse, fragmentation is a foundational part of the payments landscape in Southeast Asia, Turkey and other regions characterised by accelerated rates of e-commerce growth.

And while that can create unique challenges for foreign organisations, it shouldn’t prevent growth-oriented companies from capitalising on the opportunity at hand. Rather, it should motivate them to partner with a proven, unified, end-to-end payment provider, such as NomuPay, early in their expansion efforts. Purpose-built to accept payments, reconcile all types of transactions and send payouts in the expansion markets of Southeast Asia and Turkey through a single integration and a single bi-party contract, NomuPay provides enterprise e-commerce merchants and payment providers with a simple fix for payment fragmentation.

On the acceptance side, NomuPay’s unified acceptance technology provides a gateway-agnostic solution, whereby merchants and payment providers can integrate directly into our robust payment stack through a single, comprehensive API that covers both pay-in and payout. For marketplace merchants that require local payout capabilities, our end-to-end platform can remove your organisation from the flow of funds by seamlessly settling money acquired through NomuPay’s unified acceptance solution (and/or from any other acquiring gateway) to a dedicated multi-currency funding account. NomuPay also makes it easy for merchants to fund payouts directly if or when necessary, thanks to configurable payout workflows that are flexible enough to accommodate practically any payout use case.

The only end-to-end payment solution needed to expand in high-growth markets, NomuPay’s unified payment platform makes it easy for businesses to capitalise on rapid e-commerce growth in regions such as Southeast Asia and Turkey. Download NomuPay’s 2023 Guide to Payments in Southeast Asia and Turkey today to understand important local trends and the regional nuances necessary for succeeding in these unique areas.

Business Reporter Team

Related Articles

Most Viewed

Winston House, 3rd Floor, Units 306-309, 2-4 Dollis Park, London, N3 1HF

23-29 Hendon Lane, London, N3 1RT

020 8349 4363

© 2024, Lyonsdown Limited. Business Reporter® is a registered trademark of Lyonsdown Ltd. VAT registration number: 830519543