The case for adding alternatives to a traditional 60/40 portfolio

Sponsored by Institutional Capital NetworkBy Kunal Shah, Shan Hasnat and Rob Alldian, iCapital

As the era of easy money draws to a close, and economies reel from the impact of inflation, slower growth and geopolitical disruptions, the traditional 60 per cent equity/40 per cent bond portfolio has come under stress. The shift in the stock-bond correlation has investors seeking diversification in alternative investments, while market uncertainty continues to underscore the need for portfolio solutions that dampen volatility.

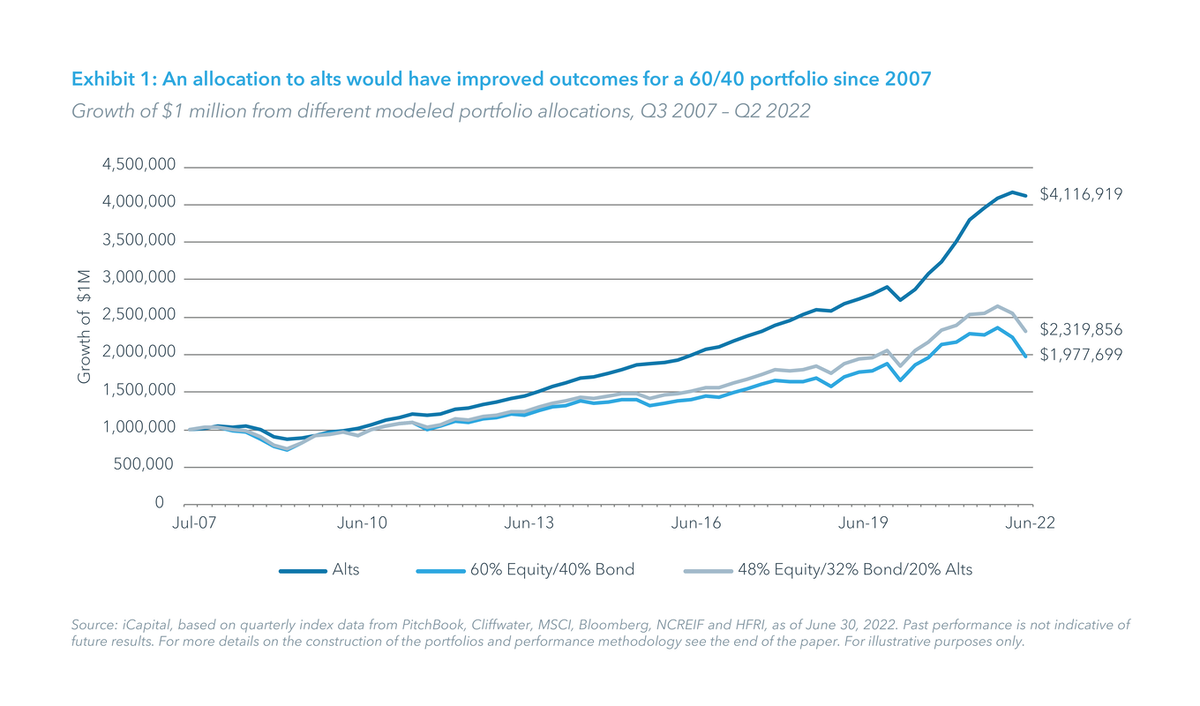

Historical data shows that a 20 per cent allocation to a combination of alternative asset classes and strategies would have notably improved the traditional 60/40 portfolio performance over the past 15 years. Reallocating proportionately from equity and fixed income, consider the historical returns of a 48 per cent equity/32 per cent bond/20 per cent alternative investments model portfolio, with the alternative investments component composed of 8 per cent private equity, 8 per cent private credit, 2 per cent private real estate, and 2 per cent hedge funds.

As Exhibit 1 shows, an investment of $1 million in the third quarter of 2007 would have returned nearly $2.3 million with a 20 per cent allocation to alts, over $340,000 more than a classic 60/40 approach. It is noteworthy that the model alts allocation on its own would have returned more than $4.1 million – double the return from the traditional portfolio. Put another way, adding alts to a 60/40 portfolio increased the total return by nearly 20 per cent, translating to an annualised returns increase of more than a percentage point. While history does not necessarily repeat itself, the increased returns of the model portfolio with alternative investments tells a powerful story.

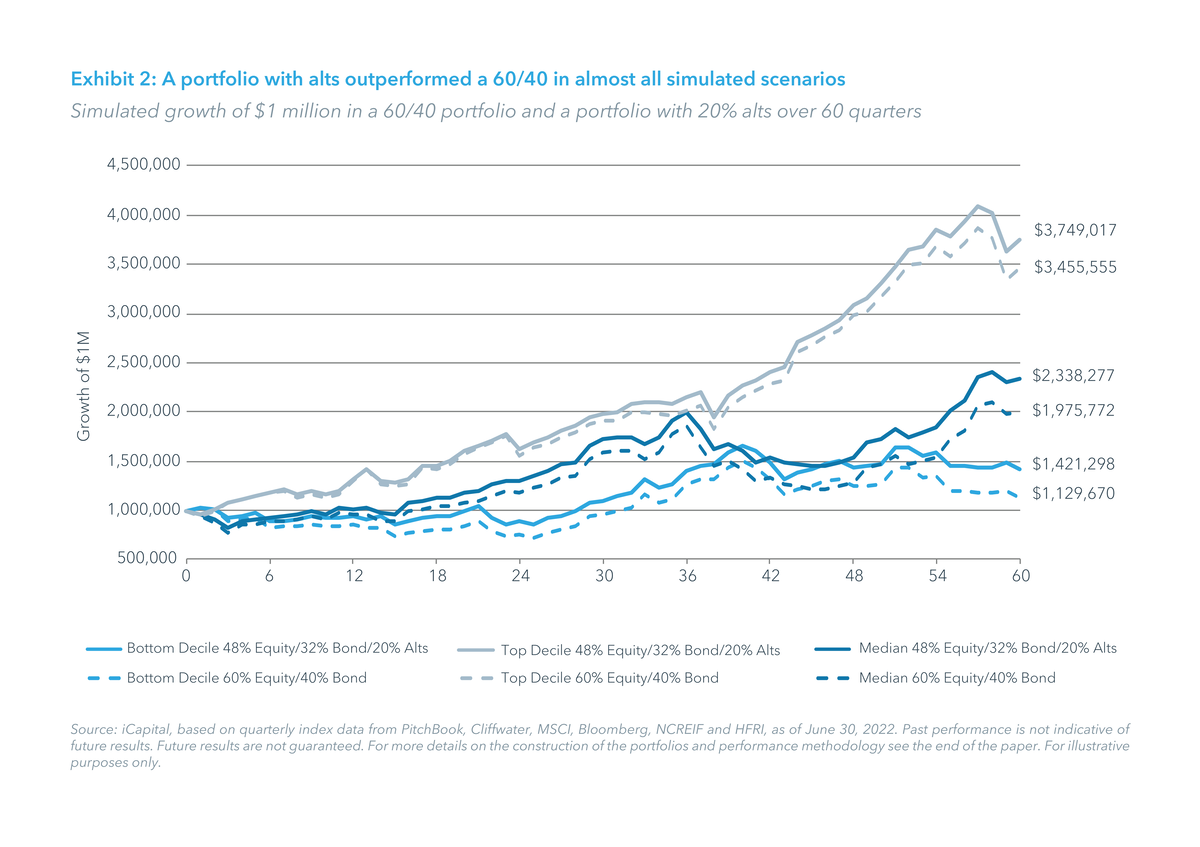

Simulated performance provides another lens with which to analyse the impact of alternative investments on a traditional 60/40 portfolio in a wide range of market environments. Using a Monte Carlo simulation, our analysis found that the model portfolio with alternative investments outperformed the traditional 60/40 portfolio in all but 128 out of 10,000 runs – that is, 98.7 per cent of the time (see Exhibit 2). The model portfolio with alternative investments would have cumulatively produced 8.5 per cent higher returns after 60 quarters at the top decile level, 17.1 per cent higher returns at the median level and 25.8 per cent higher returns at the bottom decile level. While the inclusion of alts was beneficial to a 60/40 portfolio across the board, the greater outperformance at the lower end of the outcome range highlights the protection alts can offer in more difficult environments.

While the very name “alternatives” creates a sense that these asset classes are exotic and may conjure images of opaque, pricey products with high minimums and burdensome administration, ongoing product and technological innovation has helped simplify various investment processes, with platforms that provide education, streamline administration and automate reporting. Further, these innovations have, in a virtuous cycle with rising competition, driven the entry of a wider selection of high-calibre managers into the individual investor alternatives space, and placed downward pressure on fees. This asset class is no longer exclusive or niche: private market assets are currently valued at $23 trillion, and the case to incorporate alternative investments into a well-balanced portfolio is only getting stronger.

Kunal Shah is a managing director, head of private equity solutions and co-head of research at iCapital. Shan Hasnat is a senior vice president and Rob Alldian is an assistant vice president of research and education at iCapital.

Please read our standard disclosure here.

Business Reporter Team

Most Viewed

Winston House, 3rd Floor, Units 306-309, 2-4 Dollis Park, London, N3 1HF

23-29 Hendon Lane, London, N3 1RT

020 8349 4363

© 2025, Lyonsdown Limited. Business Reporter® is a registered trademark of Lyonsdown Ltd. VAT registration number: 830519543