The state of European private equity

Sid Jain at Gain.pro outlines the findings from a recent report showing that consumer assets have been hit hardest in a PE market downturn

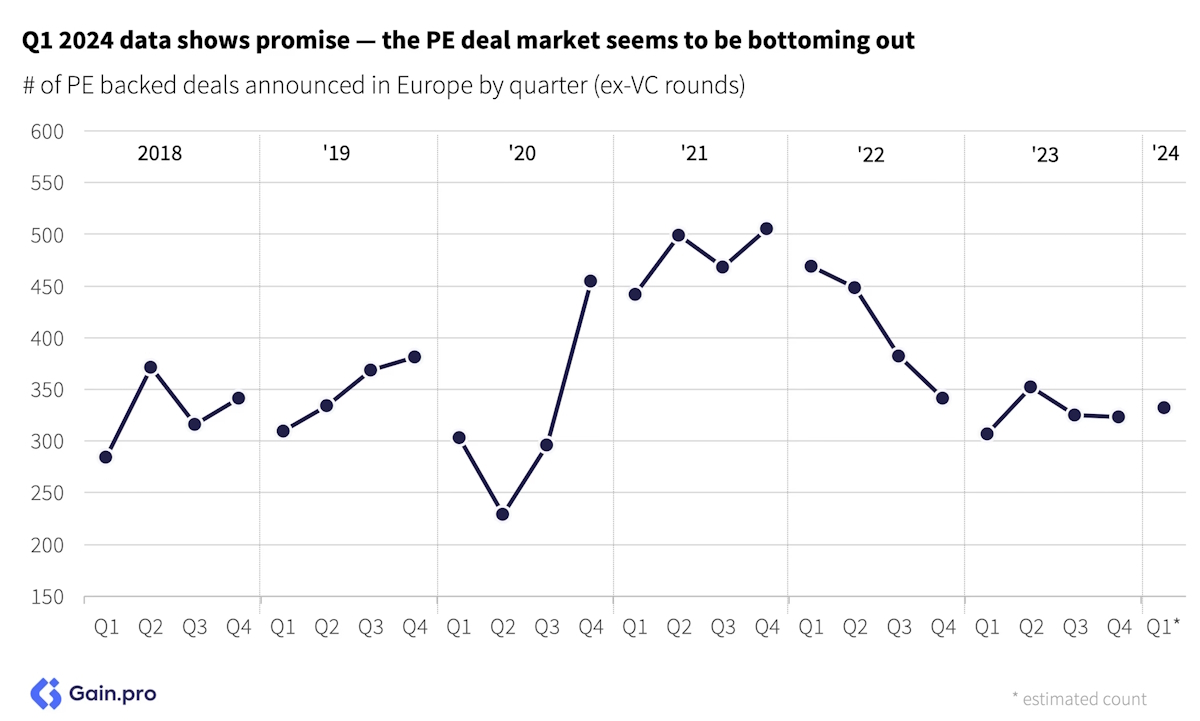

The European private equity landscape has faced significant headwinds in the last two years, with deal activity slowing down across the board. According to recent Gain.pro data, buyout deal activity in 2023 reached its lowest point in six years, with entries down 32% from their 2021 peak (Figure 1).

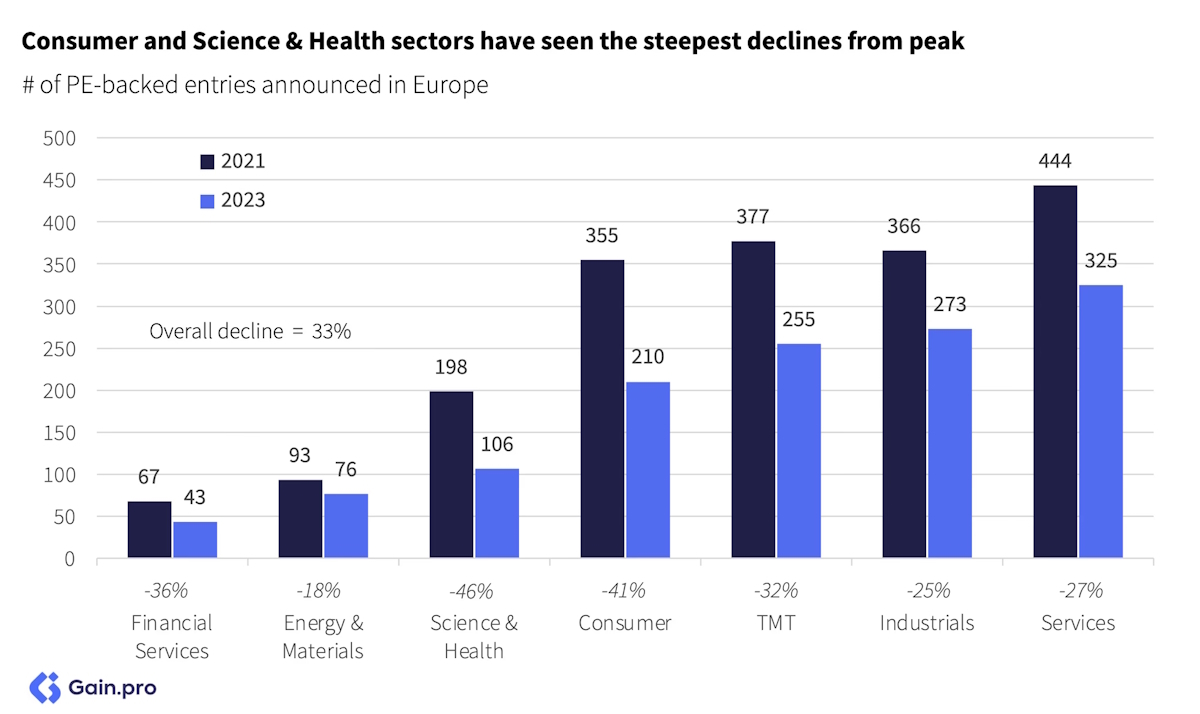

While this decline affected all sectors, consumer assets bore the brunt of the slowdown, experiencing a 41% decrease in entry deal activity. This sharp decline outpaced other sectors such as TMT, Services, Energy & Materials, and Industrials, where deal volume dropped less than 30% (Figure 2).

The shift in investor preferences is evident over the longer term. Investors are increasingly favouring asset-light, innovative, and fast-growing businesses in sectors such as Services and TMT.

The COVID-19 pandemic has fundamentally altered consumer behaviours and spending patterns, particularly affecting the retail and leisure subsectors. These changes, coupled with ongoing economic uncertainties and inflationary pressures, have made investors increasingly cautious about consumer-focused investments.

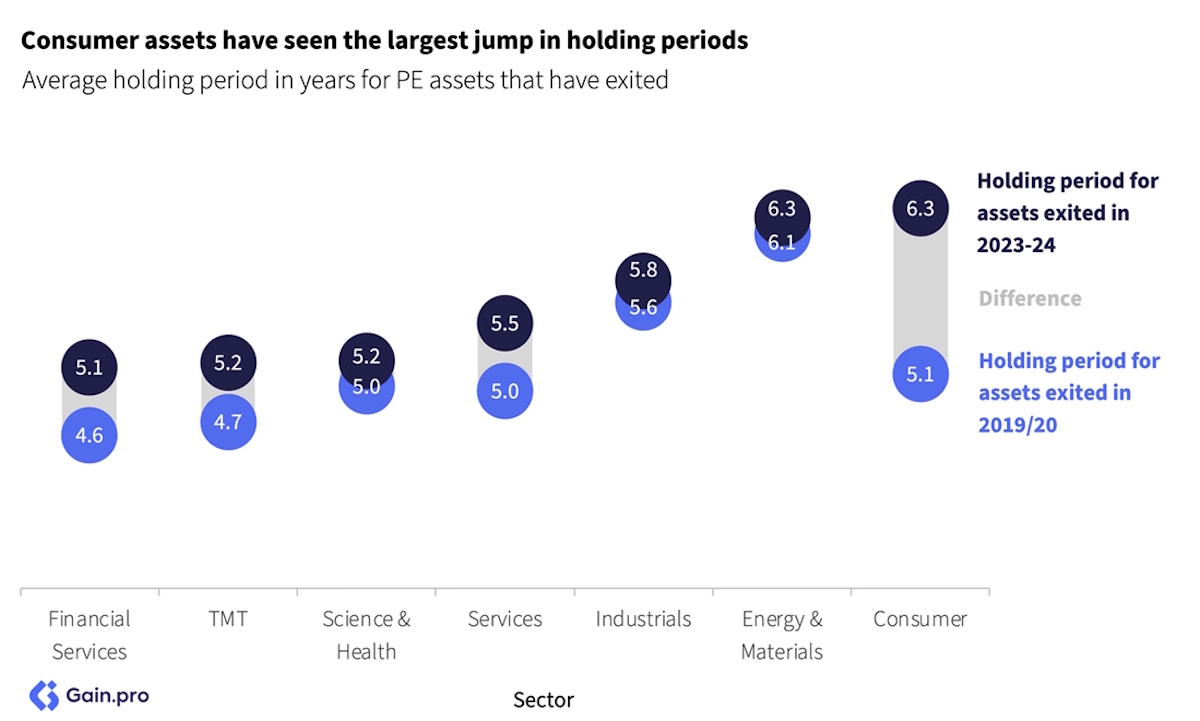

Exit data reveals that consumer assets now have the longest average holding period among all sectors, at 6.3 years (Figure 3).

This extended timeframe suggests that PE firms are struggling to find attractive exit opportunities for their consumer portfolio companies, potentially due to lower valuations or a lack of interested buyers in the current market climate.

Longer holding periods impact performance metrics such as IRR and DPI, particularly for those with a large consumer portfolio. Investors face a tough choice: whether to sell the assets at lower multiples, roll them over into a continuation vehicle, or inject more capital to keep the growth going.

Operationally, consumer assets are also facing headwinds. These businesses have some of the slimmest margins among PE-backed companies, alongside industrials. Moreover, growth in the Consumer sector is the slowest among all sectors tracked.

Compounding these challenges, buy-and-build strategies—a key lever for value creation in private equity—are least prevalent in the Consumer sector, further limiting growth opportunities. The combination of low margins, slow growth, high operational costs, and limited buy-and-build potential makes many consumer businesses less attractive to potential buyers or investors.

The case of Morrisons, one of the UK’s major supermarket chains, provides a telling example of the challenges faced by consumer-focused businesses. Morrisons, previously family-owned, was acquired by American PE firm Clayton, Dubilier & Rice in October 2021 for about £7.1 billion, following a bidding war. The acquisition was part financed with debt, a common practice in leveraged buyouts. However, the rise in interest rates since the acquisition has made this debt significantly more expensive to service.

This debt burden has severely impacted Morrisons’ ability to compete on price with other supermarkets, especially during the ongoing cost of living crisis. As a result, Morrisons has been overtaken by Aldi as the UK’s fourth-largest supermarket. To manage its debt. Morrisons has also sold assets, including a £2.5 billion strategic deal for its petrol stations in January 2024.

The challenges faced by Morrisons are not unique. Many consumer businesses are grappling with similar issues.

However, it’s not all doom and gloom for consumer assets, the current environment may create attractive entry points for PE firms looking to acquire consumer assets at discounted valuations.

Firms that can weather the current storm and successfully transform consumer businesses may be well-positioned to benefit when market conditions improve.

Sid Jain is Head of Insights at Gain.pro

Main image courtesy of iStockPhoto.com and Stadtratte

Business Reporter Team

Most Viewed

23-29 Hendon Lane, London, N3 1RT

23-29 Hendon Lane, London, N3 1RT

020 8349 4363

© 2024, Lyonsdown Limited. Business Reporter® is a registered trademark of Lyonsdown Ltd. VAT registration number: 830519543