Cutting through complexity

Julie Neal at Vendigital explains why C-Suite executives increasingly feel under pressure to make the right decisions

Board-level executives are feeling the pressure when it comes making the right decisions at the right time. This is in part due to increased complexity and the fact that many different factors must be taken into account.

But what can they do take the pressure off and cut through this web of complexity?

Research conducted by Vendigital with 201 C-suite executives at UK-based companies, has revealed that 84% believe it has become more challenging to make the right decisions over the past year, due to the need to weigh up complex considerations. Only 1% of respondents said it had become less challenging.

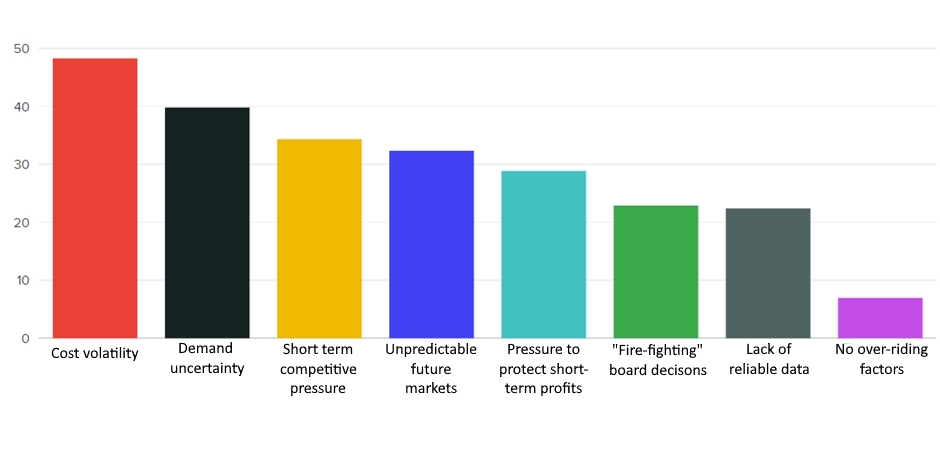

The main reason that respondents gave for this increased complexity is ‘cost volatility’, which has become a de-stabilising factor for many C-suite executives across industry sectors. Prior to the pandemic, costs were much more predictable, and this made strategy setting and implementation a less risky process.

Cost volatility is affecting commodities such as power supplies and fuel, as well as raw materials and other goods, and the ongoing climate of geopolitical and economic uncertainty, largely due to the war in Ukraine and high inflation, means it seems set to continue.

As well as cost volatility, C-suite executives identified several other factors that are making boardroom decision-making more complex and challenging including global supply shortages, depleted cash reserves and shifting consumer demands. This multiplicity of factors, combined with the prevailing macroeconomic uncertainty, is making it more challenging for Boards to make the right decisions for their business.

Top of the list of decisions that C-suite executives find the most challenging in the current climate are ‘pricing decisions’ – i.e. knowing whether to absorb cost increases or pass them on to customers, or deciding to reduce prices to drive market share.

Other decisions ranked as challenging include cost-cutting decisions; operational decisions; ESG performance-related decisions; people decisions, procurement decisions and capital investment decisions.

Almost half - 49% - of C-suite executives felt their decisions had been skewed in favour of short-term considerations over the past year, suggesting that they have been less focused on long-term objectives. One in five (22%) respondents said that they had been stuck in ‘fire-fighting mode’ over the past year.

While some C-suite executives understandably feel that cost volatility and demand uncertainty have given them little choice but to focus on short-term considerations over the past year, it is possible that long-term decisions have been sidelined due to a lack of visibility. In some cases, this could be resolved by adopting more reliable industry-specific data-based systems.

The research revealed that data trust is a significant issue for C-suite executives. Only one in five (21%) said they have total trust in the business information they are currently using to inform their strategic decisions. The remaining 79% of respondents said they trust their data only some of the time.

Without complete data trust, Boardroom executives are effectively flying blind. In today’s complex, highly competitive and ever-changing world, businesses with access to accurate and reliable data-based models will be best placed to mitigate risks and exploit opportunities.

Data visibility and agile decision making are particularly important during periods of economic downturn, so businesses need to look for ways to improve to drive their performance.

Julie Neal is a Director at management consultancy, Vendigital

Main image courtesy of iStockPhoto.com

Business Reporter Team

Most Viewed

Winston House, 3rd Floor, Units 306-309, 2-4 Dollis Park, London, N3 1HF

23-29 Hendon Lane, London, N3 1RT

020 8349 4363

© 2024, Lyonsdown Limited. Business Reporter® is a registered trademark of Lyonsdown Ltd. VAT registration number: 830519543