Improving both sides of the digital banking experience

Sponsored by WorkFusion

How intelligent automation enhances both sides of the screen with improved customer experience and a more engaging employee experience

Customer happiness is essential to the livelihood of banks and other financial institutions (FIs). So is employee satisfaction, because an engaged workplace helps attract and retain top talent who can deliver on customer needs. But in the back offices of many organisations, the drive to improve both customer experience (CX) and employee experience (EX) can create competing priorities. The issue is mundane manual work: improving speed and quality for the customer can mean employees having to execute more rote keystroke and mouse-click tasks through aging core systems and troves of documents. Inversely, softening demands on processing times for employees can mean moving away from customers’ real-time expectations.

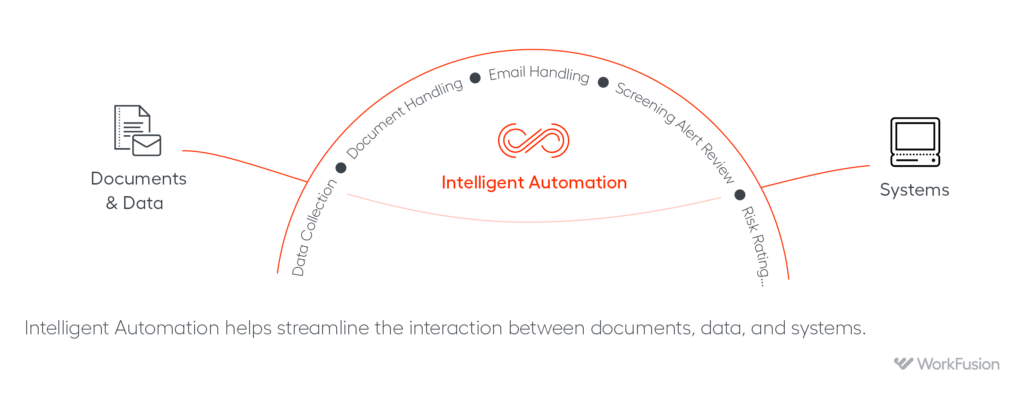

Is it possible to improve the experience on both sides of the screen to create happier customers and more engaged employees? Absolutely. Intelligent automation provides an opportunity to enhance both CX and EX by supporting digital customer interfaces with a more digital delivery of customer services.

CX must be more than a digital façade

Financial institutions invest in digital customer experiences for many reasons, but perhaps none are more important than attracting and retaining satisfied customers. Online portals, mobile apps and chatbots, for example, all make the bank easier to do business with – or at least that is the intention!

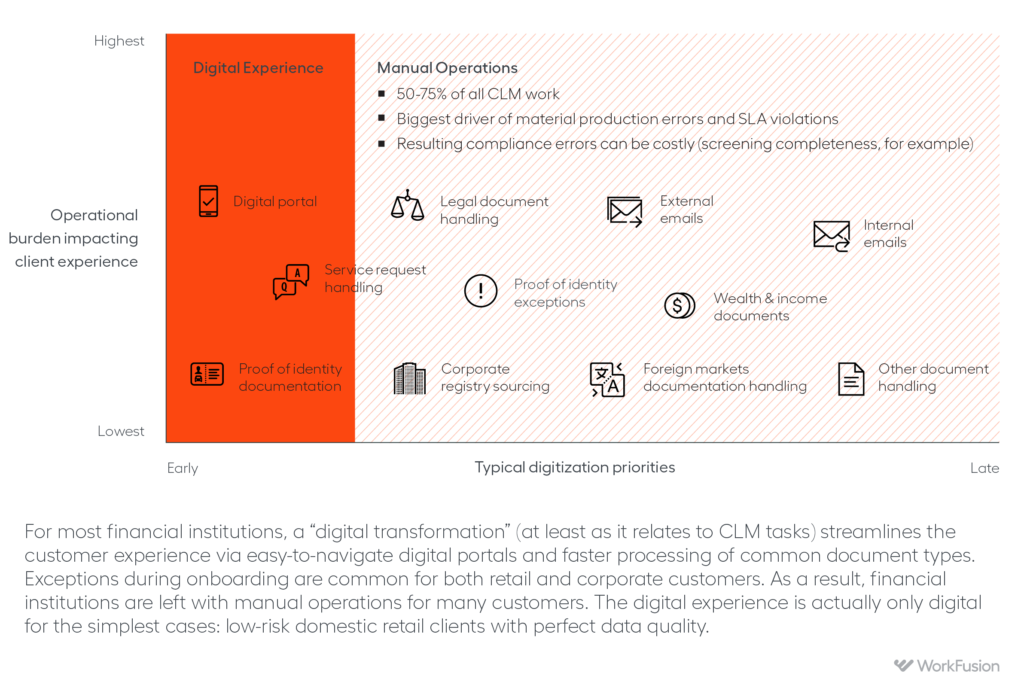

Many customer lifecycle management (CLM) interactions, including the initial account opening, involve a lot of documentation that has been difficult for banks to process digitally, because of variations in the format of the data. While it’s straightforward to receive a document upload or email, understanding and acting on them can be a different story. And every second the customer waits for their request to be fulfilled cuts into their expectation of an instantaneous experience.

Intelligent automation allows FIs to transform a digital façade into a truly digital experience. Rather than rely on manual delivery for 50 to 75 per cent of all CLM activities, as is common in the market, automation streamlines the work of the team, resulting in faster throughput and increased accuracy with stronger compliance.

As fintechs and disruptors offer consumers entirely new ways to meet their banking needs, customers look to their FIs to combine credibility and expertise with speed and ease of use. Automation can be that bridge, but it can also offer distinct additional benefits for the organisation.

Poor EX is costly and risky

Back-office teams helping deliver customer service are vital to the organisation, but unfortunately they are often tasked with mundane activities such as data collection, document handling and false-positive clearing, which impede engagement.

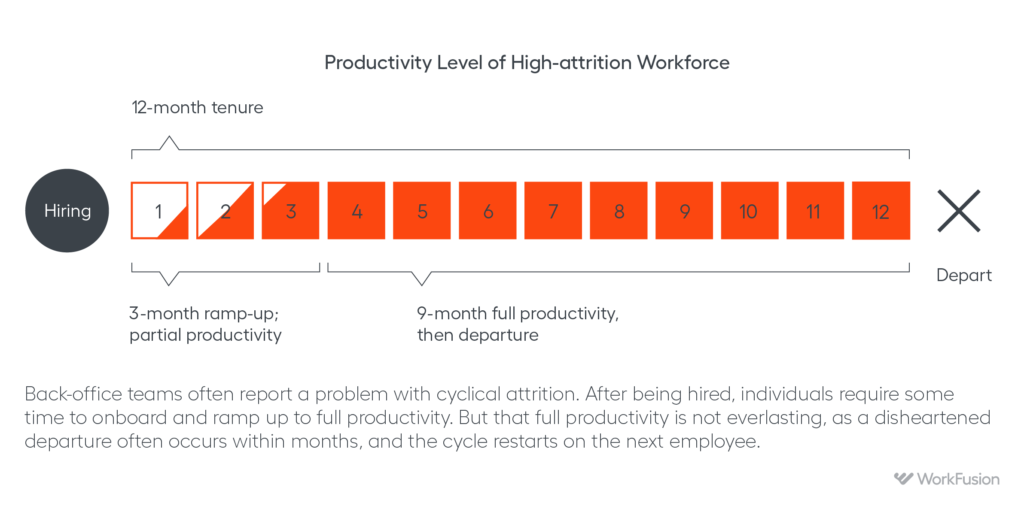

The issue is not just that the EX is poor but that it creates significant hidden costs and risk to the organization. Mind-numbing work demoralises employees and increases the risk of errors, leading management to add layers of quality control (QC). In addition, many of these back-office teams require months of onboarding for each analyst to truly achieve reliable performance, which is then, too often, followed by a disheartened departure a few months later. That means frequent hiring and onboarding costs. Further, this revolving door of personnel then requires its own solution, such as proactive over-staffing or reactive hiring of expensive contractors.

Intelligent automation provides an opportunity to transform the work, delegating over 50 per cent of the mundane work and small decisions to automation and letting analysts focus on tasks where their cognitive powers are most useful.

Examples of improving CX and EX through automation

Across several areas of the bank, intelligent automation helps create better CX with more engaging EX. Let’s look at a couple of examples:

With know your customer (KYC) document handling, banks ask existing and prospective customers to provide documents such as articles of incorporation, annual reports and business licences. They upload, then they wait. And wait some more.

For the customer, it seems like this should just be a quick review; they’re far from the first customer to provide this type of data. But it may take days or even weeks to complete. Why? Because operational teams in the background are opening documents and reconciling and entering data into various systems – manually. The team is getting through their work queues as fast as they can, but it’s slower than the customer expects, with more quality issues than anyone would like to admit.

Intelligent automation simplifies KYC document handling to collect and validate relevant data points from various sources and formats, streamlining work for employees. Analysts still provide review, but with 60 to 80 per cent less manual effort, they can focus on assisting the automation and reducing the number of re-requests going back to the customer for more information. All of which expedites turnaround time, pleasing customers.

In treasury management, customer email inquiries are common. Customers send requests to adjust authorised signers or changing addresses, for example, which to them seem straightforward. But they often sit waiting because fulfillment isn’t instant: those emails trigger manual work. There is often time lost routing the task, but, maybe more importantly, the work is not as quick as it may seem. An address change may take all day to update in five different (aging and finicky) systems. The customer expects near-instant acknowledgement, but the team racing in the background seems to never finish the work fast enough.

Intelligent automation helps streamline these email inquiries: automation tries to fulfill the request immediately, escalating to the team only when necessary. This typically saves over 75 per cent of the resolution time, and the bank’s employees can focus on other areas of customer service, not just managing inboxes.

Intelligent automation drives better CX and more engaging EX

KYC document handling and treasury management email inquiries are two of many examples of how intelligent automation improves banking. Industry-wide, AI and automation work to create happier customers and more engaged employees, a key win-win powering our screen-heavy digital age.

by Andy Bethurum, Head of Banking, Kirill Meleshevich, Head of AML and Kyle Hoback, Director of Intelligent Automation at WorkFusion

To find out more, see:

Images provided by WorkFusion

Business Reporter Team

Most Viewed

Winston House, 3rd Floor, Units 306-309, 2-4 Dollis Park, London, N3 1HF

23-29 Hendon Lane, London, N3 1RT

020 8349 4363

© 2025, Lyonsdown Limited. Business Reporter® is a registered trademark of Lyonsdown Ltd. VAT registration number: 830519543