Staff attrition in the “Great Resignation”

Mark Weil at TMF Group argues that high staff attrition rates can hamper profitability and are a leading indicator of customer service and compliance problems

The great resignation has become received wisdom on the back of heated post-pandemic labour markets. High staff attrition matters. For many businesses the reduced availability and rising cost of staff is hampering their ability to trade profitably or, in some cases, to trade at all.

Replacing a lost employee in a hot labour market is often slow, hard and expensive, so is much better avoided. The harm goes well beyond the short-term financial cost – high staff turnover corrodes customer service, dilutes company culture and creates compliance risk. In short, staff attrition is one of the best indicators of wider trouble ahead including hits to compliance and reputation.

Delving into the data

A lot of commentary on staff attrition has been based on surveys of employees’ intentions rather than their actual decisions. By managing our clients’ financial, legal and employee administration we have access to data that gives us additional insight on several hundred thousand employees, covering a broad range of sectors and job levels in over 90 countries.

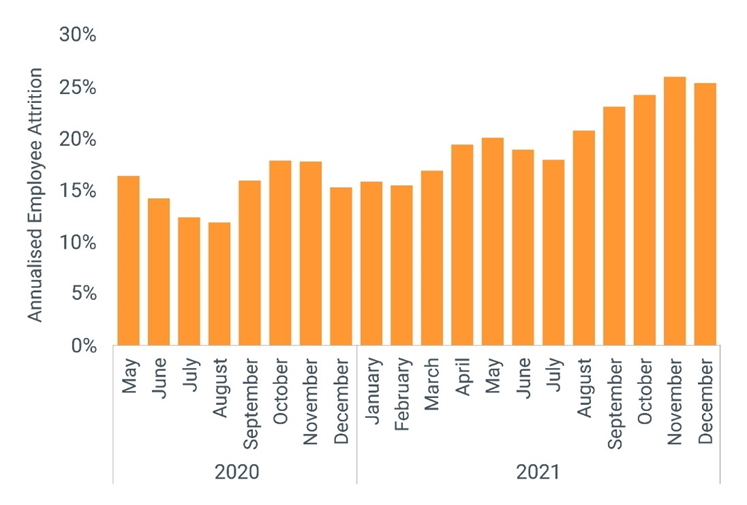

As a simple starting point, the data tells us that there has indeed been a global step up in staff resignation. Across 90 countries, attrition rose from around 15% annually in mid-2020 to 25% annually by the end of 2021. That’s a stark 67% increase in just 18 months that supports the idea of a ‘great resignation’.

Global annualised employee attrition trend (TMF Group proprietary data)

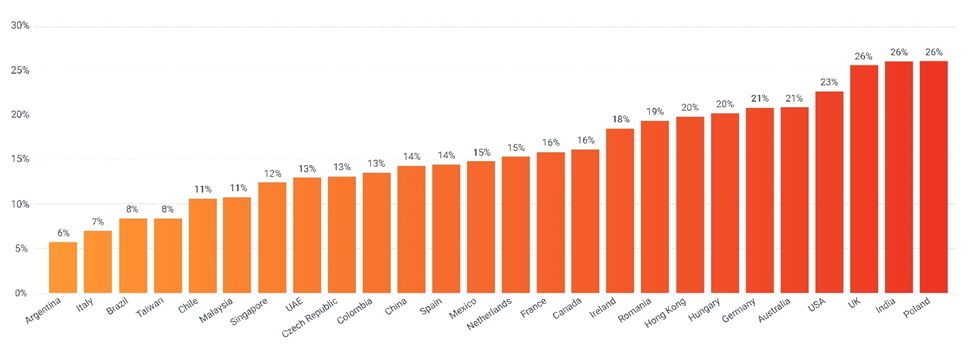

Digging deeper, a much more nuanced picture is revealed by looking at what is going on in each country and company. At country level, staff attrition over the full year of 2021 averaged around 20% but was below 10% in several countries (Argentina was the lowest at 6%) and was above 20% in several others. Topping the list at 26% each were India and Poland – both major destinations for companies establishing regional service centres in what are intended to be low cost, stable hubs supporting large numbers of other countries.

2021 average employee attrition by country (TMF Group proprietary data)

Staff attrition also varies enormously by company, with individual company attrition ranging from around 5% to 40% annually. Some of that may be down to the industry they are in or their particular circumstances, such as retrenchment or restructuring. Some will also be due to the countries they operate in and how heated those local labour markets are.

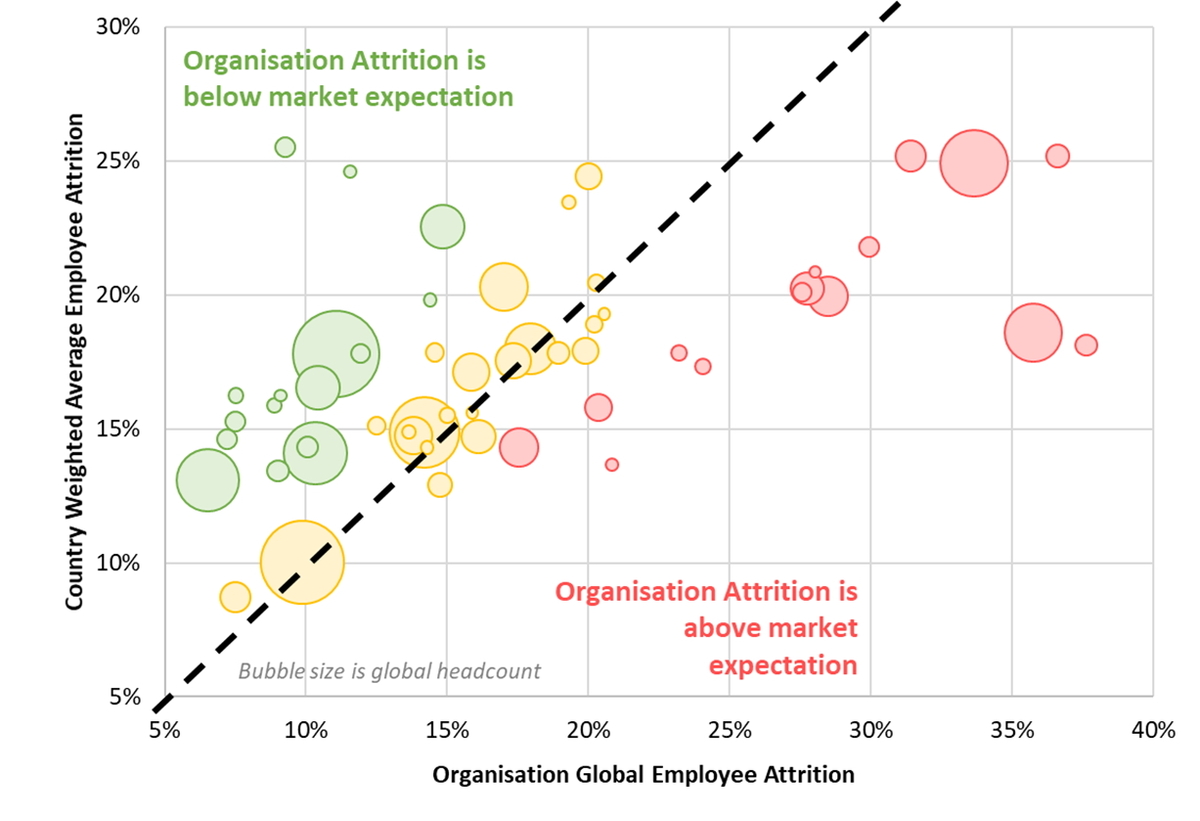

We can test for the country effect by comparing the attrition a firm is seeing with the attrition it should be seeing given the average for the countries it operates in. Interrogating the data this way shows that individual company factors matter much more than country averages.

In the chart below, we focus on companies whose country mix should make their attrition rate 15-20%; in fact those in red are at 30% to 40% attrition while those in green are at 5% to 10% attrition. That suggests a roughly five-fold difference in attrition between firms as a result of their individual circumstances, rather than from the mix of countries where they operate.

Company actual 2021 attrition versus average for the countries where they operate (TMF Group proprietary data)

Staff attrition is a headache at any time, but becomes a significant enterprise risk when it gets too high. The rise in global staff attrition, coupled with big skews in staff attrition by country and company, mean that more firms will have at least some locations where attrition is high and potentially well above their tolerance for the risk that it creates.

There is no absolute measure of the point at which staff attrition becomes a problem – each firm will set tolerance levels that it can work with. As broad guidelines from our own experience, attrition above 20% starts to become a problem and above 30% becomes a real concern.

The general rise in attrition means that the number of employees in company locations experiencing more than 20% attrition has nearly doubled from around 15% in 2020 to 27% in 2021. At the more extreme end, the number of employees in company locations experiencing more than 35% attrition has risen from 1% to 7%. That suggests a growing number of hot spots for staff attrition where companies need to intervene rapidly before a cycle of rising workload leading to further attrition takes hold.

Factoring in business complexity

An important additional lens to look through is when staff attrition is high in countries that are inherently complex to operate in. Many countries have onerous rules for doing business that are vigorously enforced, meaning that high staff attrition is more likely to lead to a compliance breach.

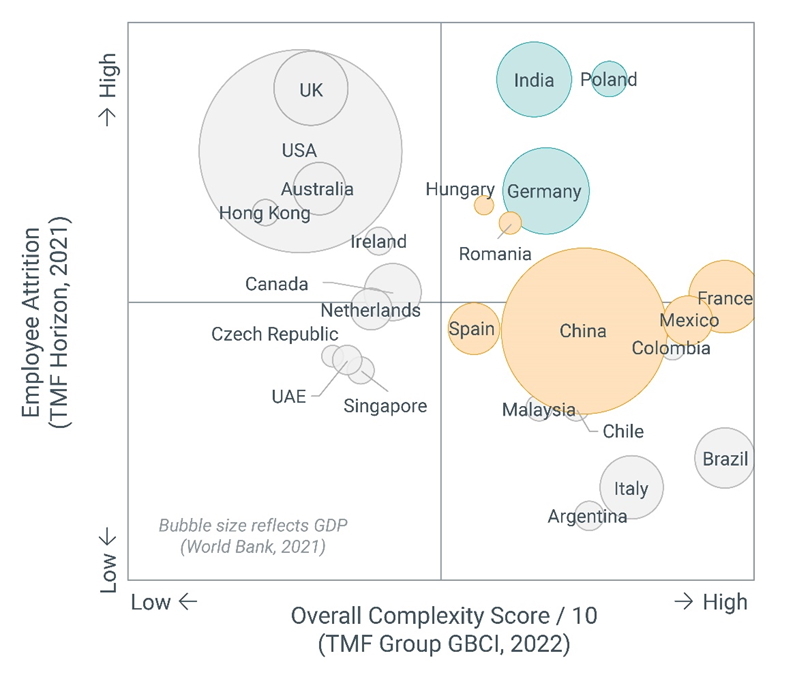

For further insight, we can look at the data alongside the Global Business Complexity Index, which ranks countries every year on around 300 criteria reflecting the complexity of their fiscal, legal and employment environments for businesses.

The chart below shows the complexity of operating in various countries versus the average staff attrition being experienced there. It highlights that certain countries – we single out Germany, India and Poland – are large labour markets, have high staff attrition and are complex to operate in.

Country average 2021 attrition versus complexity to operate there (TMF Group proprietary data)

Around 12% of employees in our data are now in locations that have staff attrition of over 20% and which also rank among the top third of the most complex countries to operate in, highlighting the risk for companies falling into that category.

To summarise, global employee attrition has indeed risen. Calling it the ‘great resignation’ ignores very different levels of staff attrition by country and by company, with some barely affected and others hard hit. That spread means that there has been a sharp increase in the number of hotspot locations where attrition will be a problem for a particular firm.

Staff attrition is a leading indicator of customer service and compliance problems, particularly when it happens in countries that are inherently complex to operate in. As such, location-level staff attrition is a key indicator on enterprise risk dashboards. Hotspots should not just be seen as an HR problem, but as a risk to service, compliance and reputation.

Mark Weil is CEO at TMF Group. TMF’s Global Business Complexity Index (GBCI) provides an authoritative overview of the complexity of establishing and operating businesses around the world. It explores factors driving the success or failure of international business, with a focus on operating in foreign markets, and outlines key themes emerging globally as well as local intricacies across 77 jurisdictions. Explore the GBCI rankings, analysis and global trends: www.tmf-group.com/gbci/.

Main image courtesy of iStockPhoto.com

Business Reporter Team

Most Viewed

Winston House, 3rd Floor, Units 306-309, 2-4 Dollis Park, London, N3 1HF

23-29 Hendon Lane, London, N3 1RT

020 8349 4363

© 2025, Lyonsdown Limited. Business Reporter® is a registered trademark of Lyonsdown Ltd. VAT registration number: 830519543