The future of payroll is FinTech

Sponsored by CloudPay

Society has moved to a more on-demand lifestyle. We look for instant gratification in all areas of our lives and tech-savvy consumers expect immediate access to entertainment, news and financial services at the click of a button. According to a recent Prosper Insights & Analytics survey, over two-thirds of Americans now use mobile payment apps.

Also referred to as earned wage access (EWA) or flexible pay, the service is offered by several solutions specific to a geographical region. But CloudPay recently launched the first global solution for multi-national companies to offer to their employees around the world: CloudPay NOW.

According to EY research in 2020, 80 per cent of individuals indicated they would use a form of on-demand pay. And it’s not just a benefit sought by lower earners or individuals of lesser financial means either. It’s about timing and cash flow. With $756 billion in outstanding credit card debt in the US and £72 billion in the UK, credit cards remain the most common form of debt. So earlier access to earned wages and financial wellbeing tools can address misaligned cash flow and potentially reduce the significant cost of credit card debt for individuals.

The CloudPay NOW app provides easily accessible financial wellbeing tools and information for use while financial decisions are being made.

For businesses, offering EWA as part of a benefits package is an opportunity to provide a high-value benefit for relatively low cost. EWA can demonstrate a company’s commitment to the wellbeing of its workforce, helping employers stand out from the crowd in the competition for talent and talent retention.

Accelerated digital payment methods

Standard payroll payment cycles are typically three days long. But it’s possible to reduce this process to seconds by deploying new card payment methods.

Virtually instantaneous payments to debit and credit cards and e-wallets are made through card rails rather than the traditional banking rails, which take much longer to process.

Businesses can use a single interface to access multiple payment solutions and issue payments to employees, statutory bodies and third parties in hundreds of different currencies around the world.

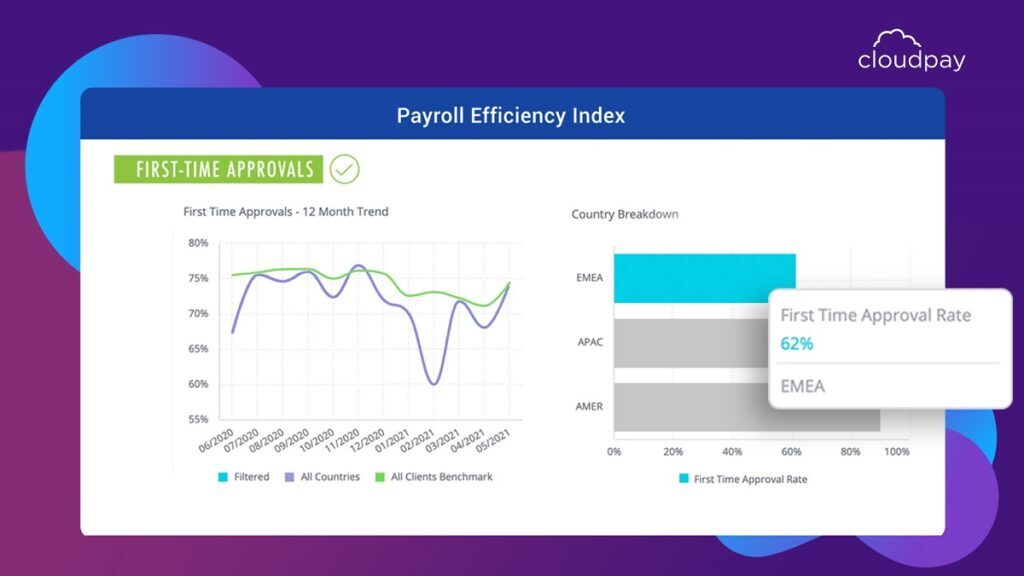

Managing global payroll effectively requires real-time visibility into what’s happening across the entire payroll function. Separated data sources slow down the reporting process and leave analysis wide open for errors.

Once the global payroll system is consolidated into a single platform, next-generation analytics will visualise and interrogate the data in context to deliver tangible business insights that optimise payroll process, deliver workforce analytics and inform hiring decisions and board-room level conversations.

This unified technology approach creates the gold standard in terms of managing global complexity, security and compliance.

Payroll automation and software integrations

Data validation is clearly the bedrock of any payroll system: validating data inputs to calculate pay and data outputs to process the resulting payments.

AI-driven robotic data validation can automate up to 85 per cent of data validation checks. It throws up repeatable exceptions and differences in data inputs and outputs and works to customised payroll controls. Exceptions are therefore flagged up for swift resolution. Software integration is a critical success factor for any business transformation. Integrations between Human Capital Management (HCM), Enterprise Resource Planning (ERP) systems and the payroll platform provide business efficiencies and a superior user experience for employees, such as allowing them to access payslips alongside other key information in a single place.

EWA is the most dramatic development in payroll to date. Driven by consumer demand and technology, it offers a compelling economic case for employers and flexibility and peace of mind for employees. It can be deployed as an addition to an existing payroll system and does not create an additional administrative burden. The risk and investment are low and the benefits to progressive employers and employees are real in terms of employee wellbeing and retention.

FinTech has ushered in a new era for payroll. At CloudPay we think of it as the modern pay experience for employers and employees. Automating and unifying the old manual processes, introducing faster, more flexible payment methods and inventing on-demand pay have made the future of payroll available to us today.

To learn more about earned wage access and CloudPay NOW, visit cloudpay.com

Most Viewed

Winston House, 3rd Floor, Units 306-309, 2-4 Dollis Park, London, N3 1HF

23-29 Hendon Lane, London, N3 1RT

020 8349 4363

© 2025, Lyonsdown Limited. Business Reporter® is a registered trademark of Lyonsdown Ltd. VAT registration number: 830519543