Why Southeast Asia is the next shopping opportunity for retail investors

Southeast Asia (SEA) remains one of the most vibrant retail markets. Its impressive growth is driven and sustained by young demographics, increasing spending power and digitally savvy consumers, bringing great opportunities for investors.

Consumer spending has shown signs of growth despite the pandemic causing a drop in affordability, which induced consumers to place more focus on necessities and choose value for money or white label products over bigger brands. The pandemic has also led to more focus on health and wellness, leading to increased expenditure on health products.

Nationwide lockdowns provided a tailwind for online shopping, and now that it is cheaper and more convenient to shop online, today’s consumer habits look a lot different. However, in-store experience remains an important element to the shopping journey in multiple categories. Consumers prefer to have an in-store experience as part of their shopping journey, particularly when it comes to groceries, apparel and footwear. As as result, footfall in shopping malls and smaller mom-and-pop shops have shown signs of reversion to their pre-Covid levels.

This article aims to explore the pace of consumer spending recovery post-Covid in Southeast Asia and changing spending habits. L.E.K. Consulting conducted the 2022 SEA Consumer Trend Survey by talking to 4,000 respondents across various countries1 in SEA about how they shop and what they shop for. The following themes have emerged:

- The SEA retail market is rebounding from Covid strongly and growing fast

- The pandemic and inflationary conditions have resulted in a shift in consumer preferences towards necessities and health products; however, in the long run spending on discretionary and durable goods is expected to increase

- Covid accelerated the adoption of online shopping, but, post-pandemic, consumers continue to value the in-store experience as part of their shopping journey

Theme 1: a fast-growing post-Covid SEA retail market

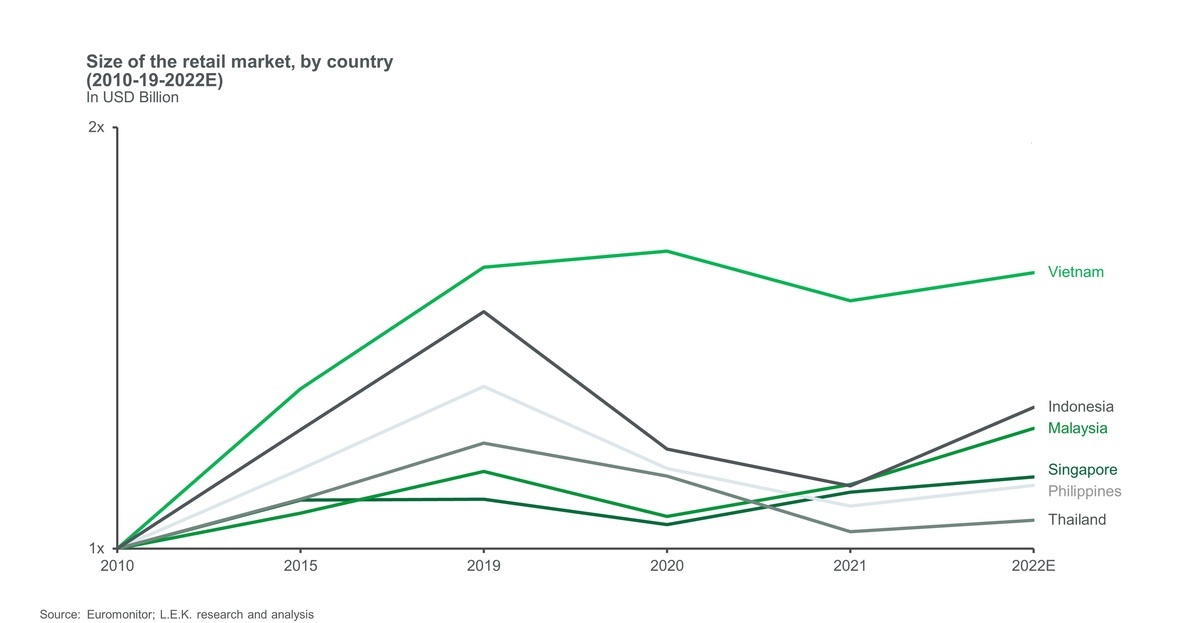

Southeast Asia is one of the fastest-growing retail markets in the world. This growth is underpinned by strong fundamentals – demographics, spending power and a willingness to spend. The pandemic caused a sudden, sharp decline in consumer spending, especially in Indonesia and the Philippines. Vietnam and Singapore were most resilient thanks to early containment measures. However, two years after the pandemic started, all SEA countries saw signs of a strong bounce-back.

Demographics: As well as its substantial population, SEA enjoys favorable demographics.

In every age group. The region’s population growth rate will be faster than the global average, and around 45 per cent of SEA’s population is in the working age group (20 to 50), also the main target segment for retail purchases.

Spending power: While Covid-19’s supply chain disruptions, lockdowns and border closures impacted income, most markets are expected to bounce back sharply owing to the responsiveness of expansionary fiscal policy. Household incomes in Indonesia and Vietnam fell only marginally during Covid-19, and these countries are also expected to witness high CAGRs of 4-5 per cent between 2021-2025. The fear of looming inflation has not impacted SEA at the same level as some other large economies at the time of writing, and domestic demand in the region is predicted to remain strong in the long run because of a revenue windfall from exports and a growing middle-income population.

Willingness to spend: Consumer spending as a percentage of household income has been

rising in SEA. This is expected to increase further, driven by changing consumption patterns, premiumisation, accessibility and strong growth in niche segments.

Theme 2: an increase in spending on non-grocery goods

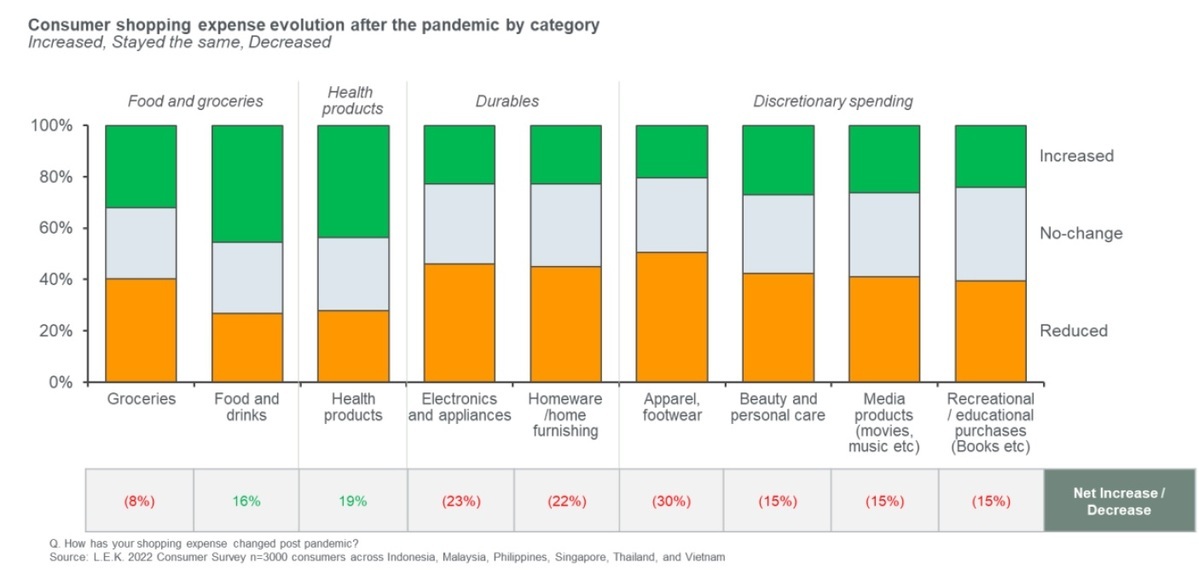

According to the L.E.K. Consumer Trend Survey 2022, the pandemic changed consumer shopping preferences as more was spent on food and health products. Emerging from Covid, consumers have been spending more on necessities and placing high emphasis on health and wellness, evidenced by the increased spend on food and beverages as well as health products.

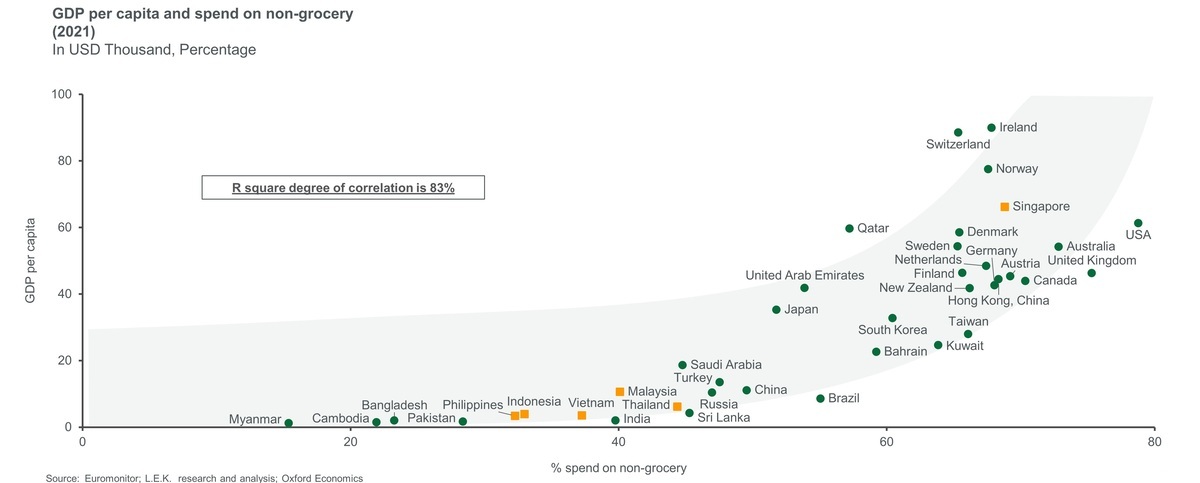

However, spending on non-grocery products (such as discretionary and durable products) is expected to increase. As seen in developed countries, as GDP per capita increases the proportion of spending on non-grocery items also increases. This happens because there is an upper limit on the spend on necessities, and as household income exceeds this threshold a larger surplus is available.

As a result, with each marginal increase in spending power, consumers are more likely to spend on discretionary items. As income levels in SEA countries increase, we expect to see accelerated spend on discretionary items, presenting an opportunity for non-grocery retailers as well as premium grocers.

Theme 3: Covid boosted online shopping, but customers still value the in-store experience

Stringent lockdowns and self-isolation during Covid resulted in the widespread adoption of online shopping by consumers, especially for durables such as electronics and home furnishings, which were mostly bought from physical stores before the pandemic.

But even though the prevalence of online shopping is here to stay, the trend also shows a gradual return to offline stores. Despite the rapid adoption of online shopping, physical stores provide the necessary offline experience and brand engagement, and thus retailers are transitioning towards an omnichannel future.

Grocery, which – excepting Singapore – represents the majority of retail spend in SEA, is dominated by traditional mom-and-pop stores, which can hold limited SKUs and brands. The dominance of these retailers is particularly strong in Vietnam, Malaysia and, to a lesser extent, Thailand. Large, organised providers account for only 10 to 30 per cent of total retail sales across SEA countries outside Singapore, with traditional stores making up the rest. The markets’ fragmentation represents an opportunity for modern retailers to capitalise on scale while providing consumers with a wider variety of SKUs and brands.

While e-commerce transformed consumer habits during Covid-19, physical stores provide the necessary offline experience and brand engagement, and retailers are transitioning towards an omnichannel future dominated by convenience stores. Hence, a strategy of moving the market from traditional retail stores towards convenience stores and supermarkets may be the best approach for potential investors, while still investing in e-commerce capabilities. Global providers have only begun to scratch the surface of SEA’s potential, with even e-commerce dominated by local players; overall, the region presents an unmatched growth opportunity.

Business Reporter Team

Most Viewed

Winston House, 3rd Floor, Units 306-309, 2-4 Dollis Park, London, N3 1HF

23-29 Hendon Lane, London, N3 1RT

020 8349 4363

© 2025, Lyonsdown Limited. Business Reporter® is a registered trademark of Lyonsdown Ltd. VAT registration number: 830519543