Crypto-currencies and the planet

Hooman Razavi DBA at IEP Canada Inc explores the environmental challenges of digital finance

Climate change is accelerating at an unprecedented rate, driven by rising greenhouse gas emissions and deforestation, leading to more frequent and severe weather events. On the other hand, the use of cryptocurrencies is growing rapidly, accompanied by increasing scrutiny regarding their significant energy consumption and environmental impact.

In light of the urgent need to reduce CO2 emissions and address escalating environmental concerns surrounding cryptocurrency mining, understanding and mitigating its environmental impact is essential. Based on (United Nations University., 2023), the energy supply for Bitcoin mining comes from a mix of both renewable and non-renewable sources. A significant portion, 45%, is supplied by coal, a fossil fuel with a high environmental cost due to its carbon emissions. Natural gas, another fossil fuel, contributes 21%, while oil provides a small 1%, adding to the carbon footprint of Bitcoin mining.

On the cleaner side, renewable energy sources like hydropower (16%), wind (5%), and solar (2%) are part of the energy mix but remain underutilized compared to fossil fuels. Nuclear power, which makes up 9%, offers a low-carbon alternative but presents its challenges, such as waste disposal. Bioenergy, at just 1%, also plays a minimal role.

This diverse energy mix shows that Bitcoin mining still relies heavily on non-renewable resources, raising concerns about its sustainability and environmental impact.

In the last decade, major cryptocurrencies have experienced dramatic price surges, resulting in substantial increases in global trading volumes and transaction counts. Recently, prominent companies such as Tesla have unveiled strategies to convert portions of their assets into cryptocurrency, while others like PayPal have committed to accepting Bitcoin and other widely-used cryptocurrencies as payment methods. This has boosted trust and global interest in the cryptocurrency market.

With the growing popularity of cryptocurrencies and their success in gaining the trust of people and markets worldwide, even governments and many central banks are now investing in launching digital currencies. The current era of cryptocurrency dominance is comparable to the meteoric rise in gold prices at the beginning of the 1970s, prompting ongoing discussions about whether cryptocurrency can replace gold.

Unlike gold, which requires prior knowledge and access to resources, cryptocurrency mining can be done with a reasonable capital investment and reliable access to electricity and the Internet. The low barriers to entry enable individuals to mine cryptocurrency using a residential electricity network.

Predicting the future trends and placement of cryptocurrencies within the financial system is challenging, if not impossible. However, the technological breakthroughs of Industry 4.0 and the resulting enhancements in security, privacy, efficiency of data transfer, and automation will continue to have a profound impact on global banking and financial systems.

Given current trends and observations, it is realistic to compute and predict that cryptocurrencies, digital currencies, non-fungible tokens (NFTs), and other blockchain assets and products will play an inevitable social, financial, and cultural role in modern societies.

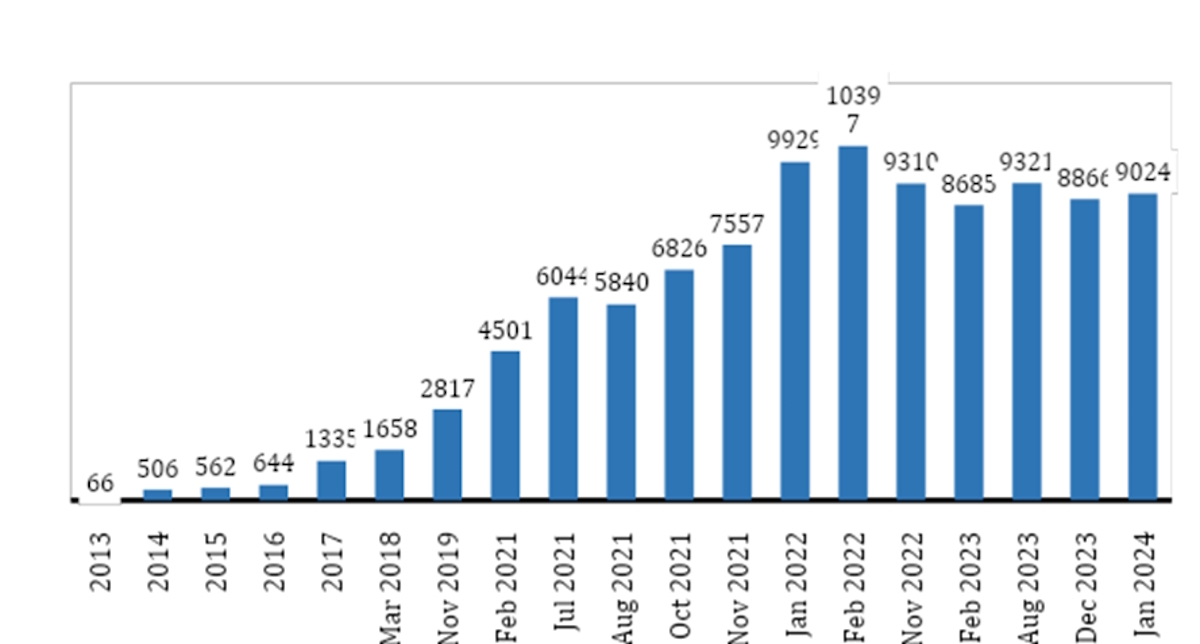

To date, more than 10,000 types of cryptocurrencies have been traded globally (Figure 1). The global crypto market cap is approximately $0.5 trillion, with BTC being the main shareholder, valued at about $525 billion as of March 2023. An average BTC miner requires about 1.5 kW of power, equivalent to 36 kWh per 24 hours of operation. This is slightly more than the daily electricity use per capita in the United States, one of the world’s top energy consumers.

While miners are becoming more efficient in energy use, the substantial increase in the total hash rate indicates that more miners are joining the BTC network. The cumulative power needed to meet the annual BTC mining electricity demand of the top 10 mining countries could provide electricity to more than 10, 31, and 52 million households in the US, Germany, and Japan, respectively. This is more than 15% of Africa’s total electricity consumption, which spans 54 countries and a population of 1.2 billion.

Processing cryptocurrency transactions requires a computational infrastructure focused on solving cryptographic puzzles, a process known as mining. Mining serves the dual purpose of validating and securing transactions while supporting the consensus algorithm, crucial for ensuring blockchain security.

This algorithm forms the cornerstone of the blockchain, providing significant assurance for its security framework. Operating within a decentralized framework, the consensus algorithm allows a multitude of nodes globally to agree on block formation. Moreover, it incorporates incentive mechanisms to promote the efficient operation of the blockchain, fostering trust within the system.

In essence, the blockchain consensus mechanism is a protocol designed to achieve distributed agreement on transactions. Due to network latency in the decentralized network, the sequence of transactions perceived by each node may vary. Thus, the blockchain system must establish a mechanism to agree on the order of transactions occurring within a similar timeframe.

This mechanism, known as a "consensus mechanism," facilitates the agreement on transaction order within a specified time window. Blockchain represents a distributed system, requiring various methods to implement fault-tolerant consensus algorithms to ensure ledger security. Commonly employed consensus mechanisms for blockchain networks include POW (Proof of Work), POS (Proof of Stake), DPOS (Delegated Proof of Stake), PBFT (Practical Byzantine Fault Tolerance), and others, each employing different strategies.

There are significant variations in energy consumption and carbon emissions across different consensus mechanisms. For example, PoW networks like Bitcoin consume substantially more energy compared to PoS systems such as Ethereum 2.0 or hybrid models like Slimcoin. Simulations reveal that transitioning from PoW to PoS could reduce the carbon footprint by up to 99%, highlighting the critical need to adopt more energy-efficient consensus mechanisms for a more sustainable blockchain future.

Regardless of the energy source, producing and transmitting electricity for cryptocurrency mining has significant environmental impacts. This makes the growing digital currency market a potentially polluting sector with an environmental footprint far exceeding some conventional methods of digital transactions. For instance, each BTC transaction is estimated to have an equivalent carbon footprint of 475,000 VISA transactions. It is projected that within less than three decades, BTC usage alone could produce enough greenhouse gas emissions to push global warming beyond the Paris Agreement’s goal of capping anthropogenic climate warming below 2 degrees Celsius.

Despite these alarming projections, the financial and technological motivations for mining cryptocurrencies have overshadowed discussions about their environmental costs.

A lack of detailed spatial data and analysis has prevented a consensus on the environmental impact of cryptocurrency. Estimates of carbon emissions for Bitcoin and other cryptocurrencies vary widely. In 2017, these estimates ranged from 2.9 to 69.0 million tones of CO2-equivalent per year.

The wide variation in carbon footprint estimates is due to differences in energy use estimates for cryptocurrency mining, partly because of uncertainties about the equipment used by miners and their exact locations. Detailed information about the equipment and location would help determine electricity usage and identify the most likely power sources, helping to estimate carbon emissions from power plants attributed to cryptocurrencies. In 2019 Christian Stoll and others conducted the first study using detailed data on mining hardware, facilities, and pools, along with pool server, miner, and device IP addresses, to estimate electricity consumption and the carbon footprint associated with Bitcoin in 2018.

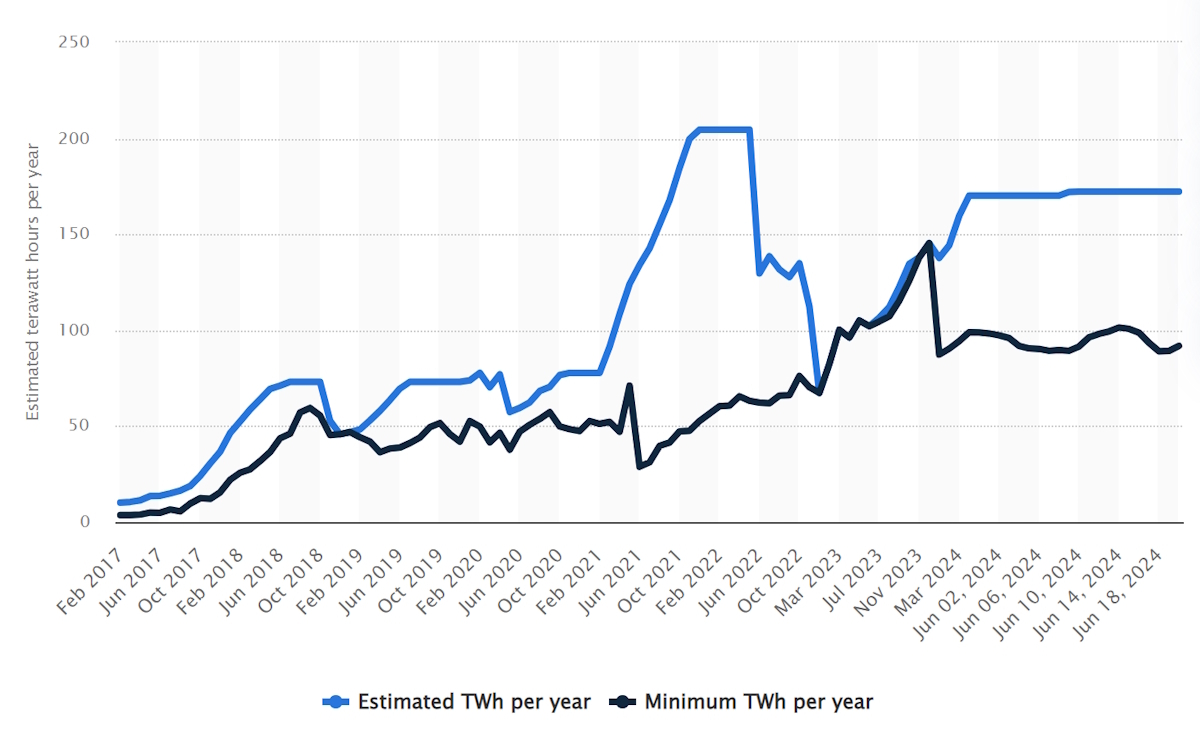

Despite considerable uncertainties about the environmental footprint of cryptocurrencies, it is generally agreed that the energy use and carbon emissions of cryptocurrencies have increased over time (Figure 2) and that the carbon emissions from crypto mining are significant, often comparable to those of small countries. However, other environmental impacts, such as water consumption, are not well understood.

Cryptocurrency transactions are generally seen as more energy and carbon-intensive than cashless financial transactions, such as those done with Visa, by several orders of magnitude. If cryptocurrencies are to become more mainstream and potentially replace traditional financial systems, understanding the broader environmental implications of this transition is crucial.

Establishing a baseline comparison between the two financial systems is necessary. Currently, little is known about how the energy use and environmental footprint of cryptocurrencies compare to the traditional financial transaction system as a whole (including fiat currencies, banking, and cashless transaction systems).

Additional studies are needed to refine estimates of the water and carbon footprints associated with cryptocurrencies as they evolve and to benchmark their environmental footprint against traditional financial systems.

Countries are now increasingly focused on regulating the industry, particularly to mitigate its carbon footprint and encourage the use of renewable energy in mining operations. Here’s a look at how different nations are responding to these challenges through policy and regulation.

China, once home to the largest concentration of cryptocurrency miners globally, took a drastic step in 2021 by enforcing a blanket ban on cryptocurrency mining. The Chinese government cited environmental concerns, alongside financial stability risks, as primary reasons for the ban.

Before the crackdown, China’s miners consumed vast amounts of electricity, primarily from coal-powered plants, contributing significantly to carbon emissions. By shutting down mining operations, the government aimed to reduce the environmental strain and align the country with its carbon neutrality goals, as China seeks to reach peak carbon emissions by 2030 and carbon neutrality by 2060.

This decision sent shockwaves through the global cryptocurrency market, leading miners to relocate to other countries with more lenient regulations.

In contrast to China’s strict approach, the United States has adopted a more decentralized stance, with regulations varying significantly from state to state. For example, states like Texas have become a hub for cryptocurrency miners, largely due to the state’s lower energy costs and its deregulated power grid.

Some mining companies have set up operations in Texas with a focus on using renewable energy sources like wind and solar power, which are abundant in the region. However, other states have been more cautious. New York, for instance, enacted a two-year moratorium on new cryptocurrency mining operations in 2022, specifically targeting PoW mining that relies on non-renewable energy sources.

The New York state government cited environmental concerns, particularly the need to meet its ambitious climate targets under the Climate Leadership and Community Protection Act, which aims to reduce greenhouse gas emissions by 85% by 2050.

This move highlights the balancing act that U.S. regulators are trying to achieve — fostering technological innovation while managing environmental impacts.

Iceland has emerged as a favourable location for cryptocurrency mining, not because of lenient regulations, but due to its abundant supply of renewable energy. Nearly 100% of Iceland’s electricity comes from renewable sources, primarily geothermal and hydroelectric power. The country has become a magnet for miners who are looking for ways to reduce their carbon footprint. Icelandic authorities have generally welcomed cryptocurrency mining, as long as it aligns with the country’s broader environmental goals.

The government’s policy is to support industries that can capitalize on its renewable energy surplus while maintaining environmental sustainability.

Kazakhstan quickly became the second-largest cryptocurrency mining hub in the world after China’s ban, attracting miners due to its relatively cheap electricity. However, most of Kazakhstan’s electricity comes from coal, which has significantly increased the country’s carbon emissions since the mining influx.

This led the Kazakh government to impose a surcharge on cryptocurrency miners’ energy consumption in 2022, aimed at addressing both environmental concerns and the strain on the national grid. The surcharge, known as the "crypto tax," adds about $0.0023 per kilowatt-hour to miners’ energy costs, and there are ongoing discussions to further regulate mining activities, particularly to encourage the use of renewable energy sources.

Kazakhstan’s government is also considering limiting the energy capacity allocated to cryptocurrency miners during peak consumption times to avoid blackouts and ensure the stability of its energy infrastructure.

The European Union is currently considering more comprehensive regulations under the Markets in Crypto-Assets (MiCA) framework, which will introduce environmental sustainability criteria for crypto assets and potentially set limits on the carbon footprint of mining operations across member states.

This framework, which is expected to come into full effect by 2024, aims to strike a balance between fostering innovation in blockchain technologies and ensuring that the industry does not derail the EU’s ambitious climate commitments.

The future of cryptocurrency mining is expected to shift dramatically as concerns over its environmental impact grow and governments impose stricter regulations. As of now, the industry’s reliance on energy-intensive PoW models, particularly in popular cryptocurrencies like Bitcoin, continues to draw scrutiny.

However, there is increasing momentum toward adopting more energy-efficient blockchain technologies, such as PoS. Ethereum’s transition from PoW to PoS in 2022 is a significant step in this direction, reducing its energy consumption by over 99.95%. This transition could set a precedent for other cryptocurrencies, leading to wider adoption of less energy-demanding consensus mechanisms in the coming years.

Experts predict that as technological innovations and market forces drive the industry, sustainable mining practices using renewable energy sources like solar, wind, and geothermal power will gain prominence. Countries rich in renewable resources may continue to attract miners, as seen in places like Iceland and parts of the U.S., while regulations will likely push mining firms to adopt greener operations.

To address the environmental challenges of cryptocurrency mining, a combination of technological and policy-driven solutions is essential. The adoption of renewable energy by mining companies is already underway in regions with abundant green power, but a broader global transition is needed. Governments can incentivize sustainable mining by providing tax breaks, subsidies, or lower energy rates for operations that utilize renewable energy sources.

Additionally, implementing carbon pricing or energy consumption limits for mining activities, as seen in Kazakhstan and Sweden, could pressure miners to reduce their carbon footprint. Another promising solution lies in the development of carbon-neutral mining protocols. Companies are already exploring techniques such as carbon offsetting, where miners invest in environmental projects that compensate for their emissions.

Furthermore, advances in mining hardware, such as more energy-efficient application-specific integrated circuits (ASICs), and innovations like layer-two blockchain solutions could improve transaction efficiency while lowering overall energy usage.

These initiatives, combined with regulatory oversight and technological improvements, hold the potential to make cryptocurrency mining more environmentally sustainable in the future.

Hooman Razavi, DBA is an AI and Business Researcher and Co-founder and CTO at IEP Canada Inc

Main image courtesy of iStockPhoto.com and Kadir bolukcu

Business Reporter Team

Most Viewed

Winston House, 3rd Floor, Units 306-309, 2-4 Dollis Park, London, N3 1HF

23-29 Hendon Lane, London, N3 1RT

020 8349 4363

© 2025, Lyonsdown Limited. Business Reporter® is a registered trademark of Lyonsdown Ltd. VAT registration number: 830519543