Fighting the rise of the fraudster

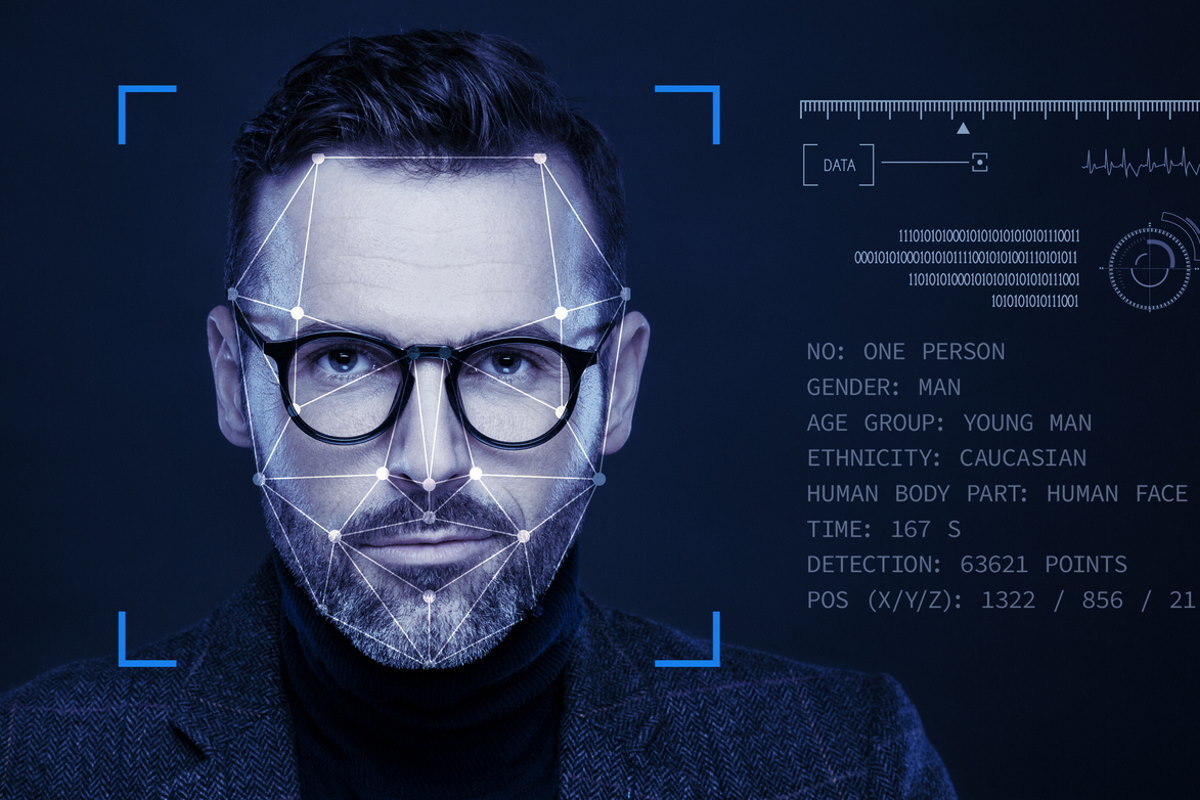

Simon Marchand at Nuance explains how businesses can protect their employees against cheats and cyber criminals by using artificial intelligence powered technology such as biometrics

The rise of hybrid working has drastically changed the way we work. 20% of British adults now say they would like to work remotely full time. For employees, working from home often means reduced commuting time, more headspace, and a better work / life balance. But this has left businesses across all sectors vulnerable to threats.

In the first six months of 2021, over £750 million was stolen from banking customers alone – up 30% from 2020. This trend has been dubbed the ‘fraud epidemic’ with the British government facing calls to tackle the problem before it gets even worse.

As we’re approaching the halfway point in 2022, businesses must arm themselves with the correct tools to protect their organisation and their customers. It’s clear that hybrid working is here to stay – so organisations must give employees the tools to allow them to work safely from any location.

Social change brings about new threats

Employees are more vulnerable working from home than in the office, as remote working lacks the traditional support and accountability structures of the office environment. When away from colleagues, instant verification is no longer as easy – and it’s harder to detect whether an “urgent” request made over the phone or by email has come from a legitimate source.

When in an office, an employee would be able to verify this by speaking to a colleague in person, however, when working remotely, this process is much more difficult. This is made even harder when time is of the essence.

While many offices now run a clean desk policy, this can’t be enforced when working at home or remotely. Even the most careful of employees are vulnerable when working in public or shared spaces. Sharing devices at home, or leaving a laptop unattended in a café - even for the briefest of moments – could give others the opportunity to steal customer details or sensitive IP.

Businesses must be diligent. Although many of these threats come from external actors, employees have been known to commit internal fraud. Fraud committed by employees is known to increase during times of personal and financial hardship, and with the rising cost of living and hangover from the lengthy coronavirus restrictions, many are still feeling the pinch.

This economic burden coupled with the ability to work from home gives employees more opportunity to commit fraud. For example, a contact centre agent who is working remotely could have the ability to note down a customer’s personal information without fear of being seen from colleagues or supervisors. This agent may then fraudulently use this information to steal from the customer themselves or sell it onto professional cyber criminals.

These fraudsters are capitalising on the economic pressure many are facing, and recruiting once-trusted employees to be their partners in crime.

Reducing the risk of fraud

When looking to tackle fraudsters, it is clear that there is not one simple answer for prevention. However, using artificial intelligence (AI) is a step in the right direction. And that should start at the outset of any interaction – when a customer authenticates themselves.

AI powered technology – such as biometrics – is able to provide an effective alternative to traditional PINs and passwords in order to confirm a person is who they say they are. Such knowledge-based security methods are outdated and businesses need to invest in new technology to better protect themselves and their consumers.

Voice biometrics is able to use sophisticated algorithms to analyse thousands of different voice characteristics to authenticate a user. Human voices are as unique as a fingerprint, and this technology is able to analyse the way we sound, form our pronunciation, to the size and shape of our nasal passage. Such depth renders it almost impossible for hackers to impersonate their victims.

On top of this, businesses can use behavioural biometrics as an extra layer of protection. This technology is able to examine how an individual interacts with their device – from how they type, tap and even hold their phone – in order to authenticate them. Organisations using this technology are able to automatically identify when fraudsters are impersonating their customers, providing an essential tool to help protect businesses and their customers when making digital transactions.

Biometrics also enable businesses to put in place a new type of clean desk policy. Instead of asking customers for personal information and authenticating them through this route, biometrics enable consumers to be verified based on unique characteristics. This can reduce and even eliminate the need to have any personal customer information on an employee’s desktop.

Businesses using this technology no longer need to provide employees access to sensitive customer information, such as date of birth, addresses and security questions – significantly reducing the potential for employee fraud.

Employing biometric technology has numerous benefits for businesses, from lowering operational costs to improving the speed and efficiency of the customer experience. However, these technologies can also help transform the working lives of employees. Using AI to authenticate consumers allows employees to spend their time focusing on what they’ve been employed to do, helping their customers.

As fraudsters now use increasingly sophisticated methods to scam people, businesses must invest in new technologies to help protect themselves, their employees and their customers. Biometrics is fast becoming a key tool in the fight against fraud.

Traditional knowledge-based security questions are no longer fit for purpose, and voice and behavioural biometrics working in tandem can provide a solution for this growing problem. With remote working here to stay; businesses need to equip their employees with the best tools to defend their organisation, and - critically - their customers, from the threat of fraud.

Simon Marchand is Chief Fraud Prevention Officer at Nuance

Main image courtesy of iStockPhoto.com

Business Reporter Team

Most Viewed

23-29 Hendon Lane, London, N3 1RT

23-29 Hendon Lane, London, N3 1RT

020 8349 4363

© 2024, Lyonsdown Limited. Business Reporter® is a registered trademark of Lyonsdown Ltd. VAT registration number: 830519543