Forrester’s 2025 predictions for smart manufacturing and mobility

Forrester’s VP principal analyst Paul Miller reveals the most important predictions for business and technology leaders in manufacturing and mobility in 2025.

Asset-intensive industries such as manufacturing and transportation quickly feel the pain when energy prices rise, raw materials are harder to access and borrowing money for capital projects becomes more expensive. They were hit by all of those and more in 2024, forcing leaders to focus even more than usual on managing costs and improving efficiency.

In the mobility sector, the seemingly inevitable transition from fossil fuels to electrification slowed in many countries as a combination of declining subsidies, high upfront costs, patchy infrastructure and looming tariffs made buyers pause.

We don’t anticipate any dramatic improvement in the global macroeconomic situation in 2025, but we see plenty of opportunity for leaders across manufacturing and mobility to use technology to adapt to the tricky environment in which they and their customers find themselves.

More than 25 per cent of big last-mile service and delivery fleets in Europe will be electric

It’s hard to miss frequent headlines about a dramatic fall in sales of electric vehicles during 2024, especially in Germany and some other European countries. There’s a lot to unpack about the short- and longer-term trends at play, but this wobble in the car market masks a good news story in the electrification of larger fleets of small vans.

One-third of DPD’s last-mile fleet in the UK is fully electric, rising to 90 per cent in London and other cities. British Gas aims to electrify its entire van fleet in 2025, and Amazon operates more than 1,000 electric vans in Germany (and over 15,000 in the US).

Across the continent, parcel delivery firms, utility companies and local governments operating large fleets of small vans over relatively short distances see electrification as an opportunity to manage costs while lowering carbon emissions.

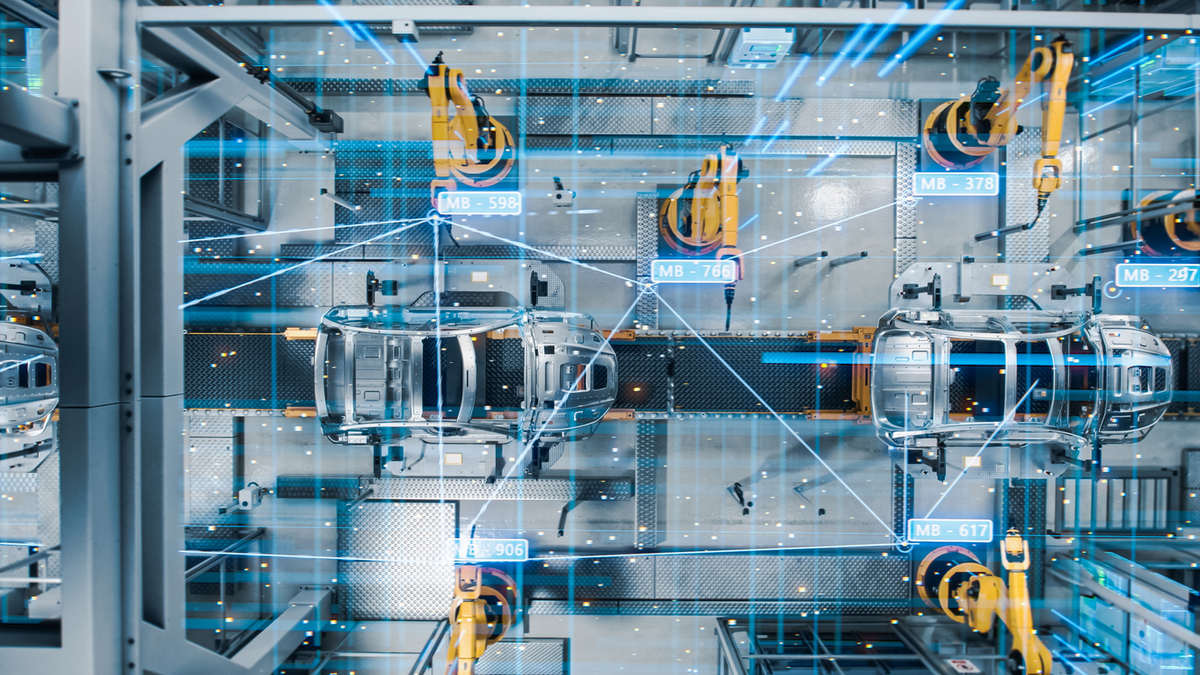

Less than 5 per cent of the robots entering factories and warehouses will walk

Investors, analysts, journalists, bloggers and random sci-fi fans just love geeking out about robots that walk, but the compelling use cases for their legs are less common – or obvious – than most of these individuals believe.

ANYbotics and Boston Dynamics offer four-legged robotic dogs for inspection, safety and mapping use cases; Agility Robotics’ bipedal robots can be seen in some Amazon warehouses; and Boston Dynamics, Figure and Tesla have all tested their humanoid robots in automotive plants.

These robots have a wow factor, but they may not have the best form factor for addressing the dull, dirty and dangerous tasks of industry. We should all focus more on the task we’re trying to complete and less on how cool the robots look.

A major carmaker will make significant cuts to its digital team

The automotive sector is struggling to cope with electrification, fast-moving new entrants to the market, and the rise of software-defined vehicles, which more tightly integrate hardware and software within the car. Established carmakers invested billions of dollars in building digital practices that were meant to help transform 20th-century excellence in physical engineering into 21st-century excellence in digital engineering.

On balance, it’s not going particularly well. General Motors announced plans to cut 1,000 employees from its software and services division this year, and its competitors are likely to follow suit. Cars are becoming more connected and more digital, and they’re able to add new features with over-the-air updates.

Ecosystems underpin the future of mobility, and today’s carmakers must adapt to a future in which they might not create – or even control – the digital experiences within their cars.

Read more by downloading Forrester’s complimentary 2025 Predictions Guide

Business Reporter Team

Most Viewed

Winston House, 3rd Floor, Units 306-309, 2-4 Dollis Park, London, N3 1HF

23-29 Hendon Lane, London, N3 1RT

020 8349 4363

© 2025, Lyonsdown Limited. Business Reporter® is a registered trademark of Lyonsdown Ltd. VAT registration number: 830519543