From survival to success: progressive banking modernisation in 3 simple steps

Sponsored by Backbase

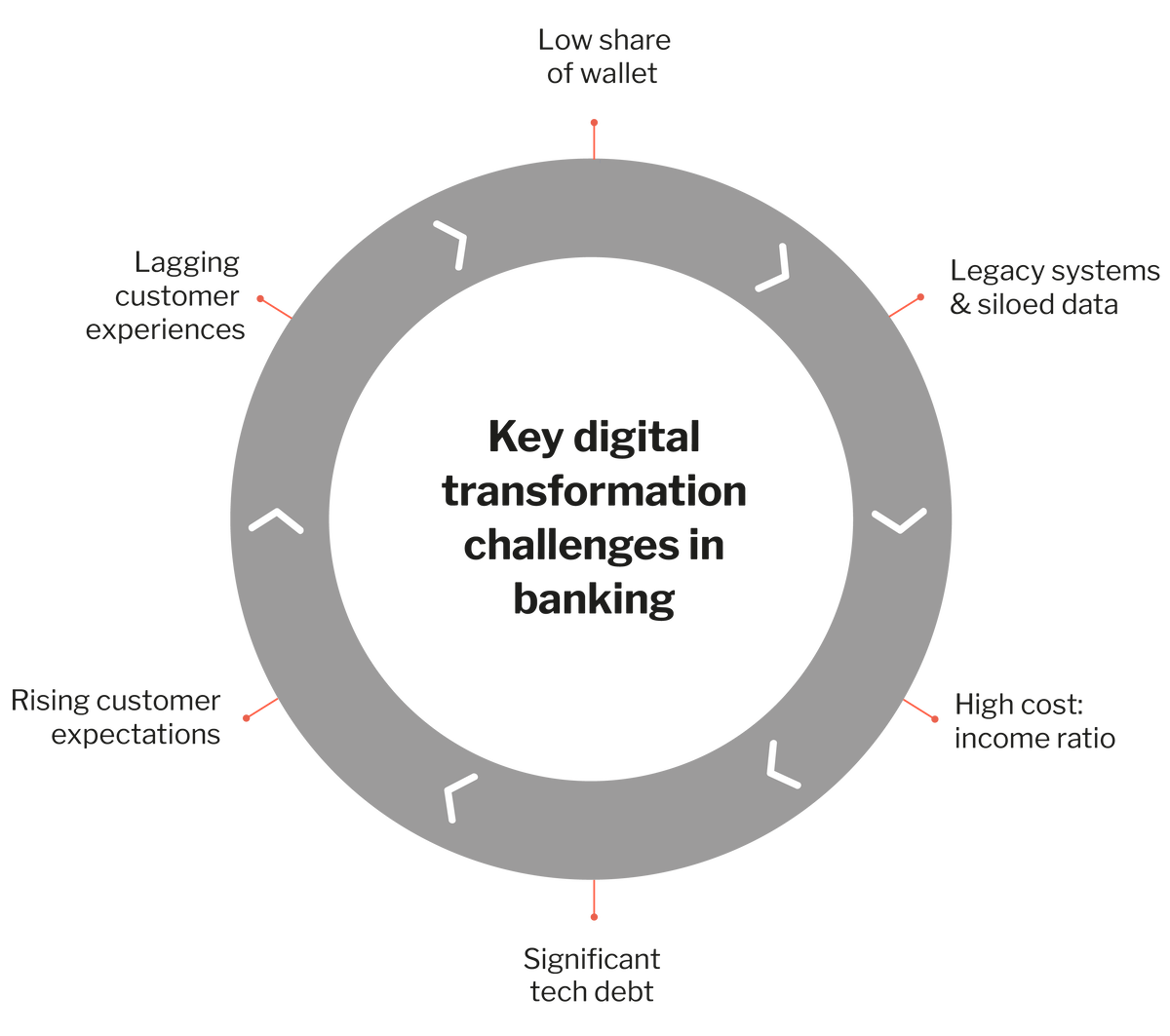

Traditional banking will not survive. The sector’s digital evolution has been nuanced, and every advancement has come with hurdles that demand careful consideration.

Looking back, there have been no unequivocal winners in the digital transformation race, and the data proves it. In fact, according to a study from McKinsey, only 30 per cent of banks have successfully implemented their digital strategy – meaning a whopping 70 per cent have failed to achieve their objectives.

The last decade has shown us that we need to give up on our continued efforts to modernise monolithic product- or channel-centric banking architectures. Unintentionally, we’ve created a “spaghetti” landscape by incorporating digital functionalities – such as online banking, mobile payments, e-statements and digital documents – within the existing framework, rather than engineering the streamlined platforms our customers need.

That means greater customer dissatisfaction, as well as decreased employee efficiency. Both groups now have to juggle various channels for fundamental information and basic transactions, adding friction and frustration to their user experience.

It’s become clear that using traditional methods to modernise legacy banking tech puts banks at the risk of implosion. That’s why we need to move away from product-centric models and focus on creating customer-centric architectures.

Go beyond survival with progressive modernisation

It’s crucial to acknowledge that modernisation in banking isn’t a sprint, it’s a marathon. As new technologies emerge and customer expectations rise, your bank needs to become lean and agile to adapt to these changes.

In the current era of banking, that means adopting the “progressive modernisation” approach, which focuses on removing the constraints imposed by outdated systems. By incrementally replacing your bank’s legacy tech, hollowing out your core and constructing a modern customer-centric digital banking architecture, progressive modernisation will allow you to reimagine your essential journeys and adopt a future-proof, omnichannel platform strategy.

Step 1: Decompose your bank’s complexity

Our recommended strategy for banking modernisation is in line with McKinsey’s, where your bank systematically eliminates or decomposes unnecessary complexity within your core banking systems, such as redundant capabilities, tools and business logic. Let’s take a look at two viable options:

- Hollow out the core: Extracting the customer-facing capabilities and integrations from your core banking system, then relocating them to the system of engagement. This approach allows you to spread costs out over an extended period so you can prioritise modernisation based on urgency, all while maintaining lower overall levels of risk.

- Go greenfield. Establishing end-to-end journeys on top of a greenfield tech stack, which would operate concurrently with your existing banking architecture. You’d have the flexibility to initiate a new line of business within your tech stack, without imposing additional strain on your current setup.

Step 2: Simplify your banking architecture

Over the years, we’ve guided more than 150 customers worldwide as they simplified their banking architectures. And, more often than not, we found disconnects between various customer-facing, middle-office and back-office channels, as well as core banking systems and CRMs.

Those disconnects result in an inconsistent user experience and elevated operational expenses. And that’s why we recommend streamlining your architecture, which will empower your bank to future-proof your operations, seamlessly scale and readily embrace emerging tech.

It all starts with the following:

- Unifying your channels. Shifting from a point-by-point journey model to fully integrated channels will enable your bank to stand out through innovative, personalised experiences.

- Unifying your integrations. By unifying your back-end systems with an industrialised middleware layer, you’ll be able to seamlessly connect your channels, streamline your operations and spur innovation.

- Hollowing out your core. Strategically extracting non-essential components will help you create a leaner, more adaptable core banking system, fostering resilience and accelerating your modernisation.

- Unifying your data. Integrating your disparate data sources through an analytics platform and visualisation will help you yield increased operational and analytical insights.

- Unifying your infrastructure. Transitioning from a traditional setup to a cloud infrastructure can help eliminate the necessity of maintaining data centres.

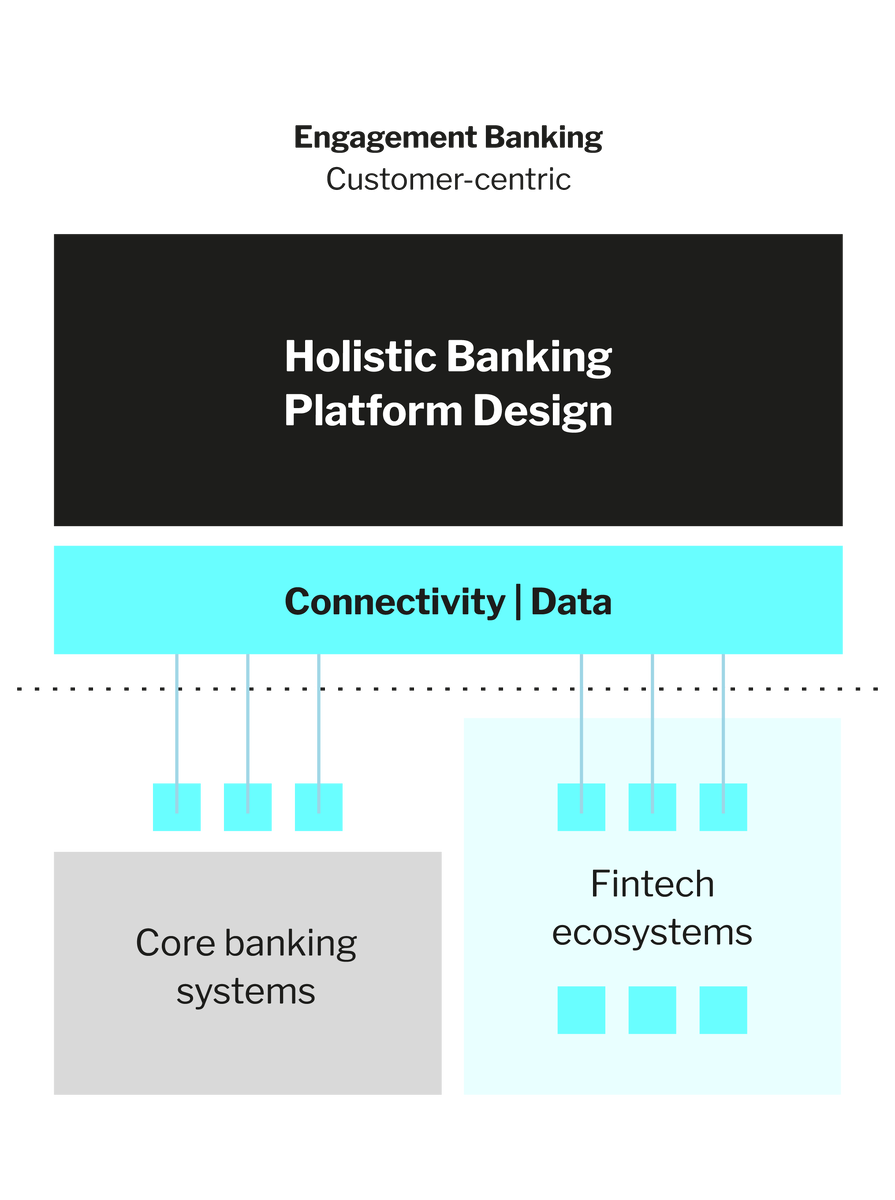

Step 3: Adopt Engagement Banking

Of course, you’ll want to change a lot of things, and quickly. Our advice? Start small. Don’t try to solve all your problems at once. Instead, run an impact scan on your banking journeys to identify and prioritise your pain points, and then build up from there. You can begin creating business value, journey by journey, through incremental changes, rather than “big bang” transformations. By locking in early successes, you’ll build confidence and momentum within your bank, and your customers will notice the difference.

We also recommend adopting Engagement Banking, a personalised, interactive approach that leverages cutting-edge digital tools to enhance the customer experience and foster deeper relationships. Where digital banking focuses on convenience and accessibility, Engagement Banking aims to create a more connected, customised customer experience.

You can read more about it on our website, where you can also browse through our hands-on guides, our insightful blogs, and even our cutting-edge podcast, Banking Reinvented.

By Jouk Pleiter, Founder/CEO, Backbase

Meet the author

Jouk Pleiter is the Founder/CEO of Backbase, the company behind the award-winning Backbase Engagement Banking Platform. He founded Backbase in 2003, and after a short stint creating software across various sectors, the company refocused on the financial industry. Pleiter then spearheaded Backbase’s mission to revolutionise the banking system, so financial institutions don’t just interact with the people they serve but actually engage with them.

Before Backbase, Pleiter was president and co-founder of Tridion, one of the world’s leading WCM software vendors, later acquired by SDL and renamed SDL Tridion. Before Tridion, Pleiter cofounded Twinspark Consultancy, one of the first interactive web agencies in the Netherlands. He holds a Master of Business Administration degree from the University of Groningen.

Business Reporter Team

Related Articles

Most Viewed

Winston House, 3rd Floor, Units 306-309, 2-4 Dollis Park, London, N3 1HF

23-29 Hendon Lane, London, N3 1RT

020 8349 4363

© 2025, Lyonsdown Limited. Business Reporter® is a registered trademark of Lyonsdown Ltd. VAT registration number: 830519543