The need for a flexible core banking platform built to adapt to an evolving market

Sponsored by finova

Markets are in an extremely volatile state. Having hit double digits last month, inflation is at its highest since the 1980s, and interest rates are spiking too. Neither are showing any signs of slowing down, and as the financial constraints of the cost-of-living crisis continue to squeeze consumers, a knock-on effect is naturally being felt by the mortgage market.

People’s spending ability is changing, with the BoE reporting that UK consumer credit card borrowing increased 13 per cent in July compared with the previous year. With that, so too is product demand. As such, lenders need to be on the ball and ready to adapt offerings to fit the needs of customers and ensure their products remain up to date and relevant.

To do this, lenders require a flexible core banking platform designed to evolve with the times and which is capable of being updated quickly and easily – crucially, by the lender themselves.

Why self-serve is so important

The ability to self-serve on lending policy is vitally important in the currently fierce lending environment. Turbulent economic factors are driving up the Bank of England base rate, impacting the profit margins of existing products.

To address this, lenders would traditionally have to request that their software provider make the necessary changes. However, as one might expect, in times such as these vendors are inundated with requests of this kind, so lenders would have to join the queue before they saw any changes.

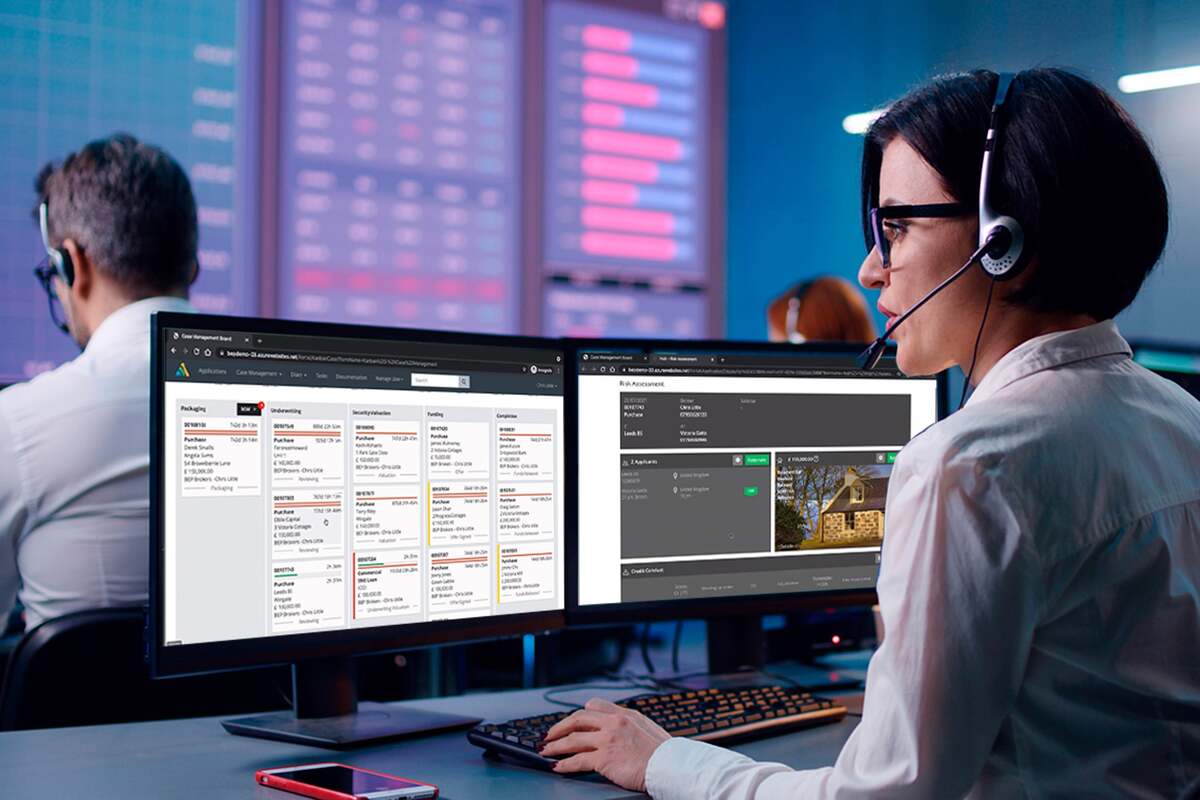

However, lenders equipped with a core banking platform such as our Apprivo² system are empowered to configure these changes internally, hugely increasing operational efficiencies while avoiding associated costs and delays of outsourcing. Being able to self-serve customers to meet their commercial needs, helps lenders adapt at pace to narrowing margins.

How open banking can take this one step further

While self-serve functionality delivers the benefits already aforementioned, technology is readily available to build on this and take it one step further. For all that it is worth, ultimately, empowering lenders to redefine their policies themselves only adds to their list of manual administrative tasks.

However, Open Banking holds the key to unlocking even more seamless loan origination. With it, self-service can be revolutionised and even automated, removing the need for lenders to key in these updates themselves.

Open Banking grants lenders access to a wider and richer array of customer data than what has historically been available. The data can be used to create a dashboard that presents income and expenditure trends, risk factors, credit commitments and automated affordability calculations. Such a granular overview lets lenders understand their customer and their financial circumstances in entirely new ways.

With this insight, and by harnessing the newest technology, platforms such as Apprivo² can make steps towards real-time personal pricing. By combining flexible products and pricing, credit reference agency (CRA) service test scorecards, Open Banking integrations, and know your customer (KYC) and anti-money laundering (AML) compliant checks, lenders can make smart decisions tailored to individual customers.

If customers consent to sharing this data, lenders can make affordability assessments in real time, and design a product bespoke to them. It would no longer be a case of one-size-fits-all products. Instead, customers would be presented with a product designed specifically with their needs and affordability in mind.

The benefits are twofold – while the customer enjoys a personalised experience tailored just for them, the lender will more than likely have improved retention as customers could not possibly find a better service anywhere else.

The market is changing, and the world around us is too. Lenders must make sure they have invested in a core banking platform that will not leave them behind. Open Banking is set to explode in the coming years, or even months, and with that so too will this personalised approach. If lenders do not adopt this technology, they will fail to adapt to the versatile and evolving market and will ultimately risk losing business elsewhere.

Click here to find out more.

By Chris Little, Chief Revenue Officer, finova

Business Reporter Team

Most Viewed

Winston House, 3rd Floor, Units 306-309, 2-4 Dollis Park, London, N3 1HF

23-29 Hendon Lane, London, N3 1RT

020 8349 4363

© 2025, Lyonsdown Limited. Business Reporter® is a registered trademark of Lyonsdown Ltd. VAT registration number: 830519543