Unlocking financial services: integrated planning for better decisions and compliance

In the fast-paced world of financial services, agile, integrated and reliable planning and decision-making are more critical than ever.

As a finance manager in a bank or financial services company, you’re undoubtedly familiar with the challenges of managing information silos, ensuring data reliability and maintaining collaboration across various departments to deliver scenario-modelled plans and forecasts. These difficulties hamper your ability to add value to the business to enable it to achieve better returns, a stronger balance sheet and improved liquidity.

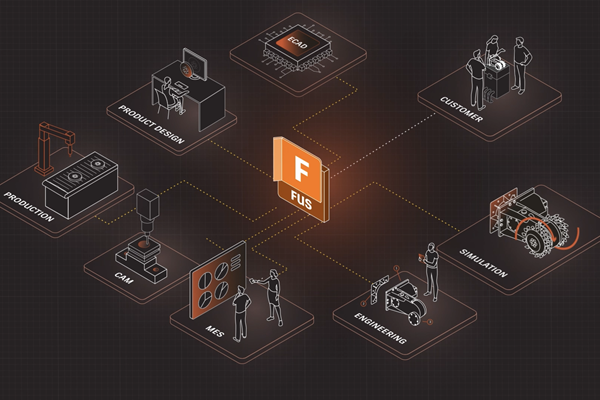

At Board, we deeply understand these drivers, which is why we offer a comprehensive platform designed to transform how financial institutions operate – providing a single version of the truth and aligning people, processes and KPIs across the enterprise.

Understanding the challenges in financial services

Financial services organisations often face numerous problems that can impede their ability to make timely decisions and confidently comply with regulations such as recovery and resolution planning and consumer duty.

Key among these are:

- Information silos: Different departments often operate in isolation, leading to multiple versions of the truth and fragmented processes.

- Low data reliability: Disconnected decision-making processes result in data that is often unreliable and inconsistent.

- High manual effort: Excessive use of Excel and email for critical business processes leads to inefficiencies and increased risk of errors.

- People and process misalignment: There is often a disconnect between strategy, finance and operations, making it difficult to align goals and actions across the organisation.

As highlighted in our most recent Global Planning Survey, despite 72 per cent of respondents believing their business is equipped for agile planning, only 16 per cent engage in continuous agile planning capable of responding to changing market conditions. Prioritising continuous agility – the gold standard of planning – is crucial for a business to fully realise complete planning transformation.

Solutions that solve challenges, achieve objectives and anticipate new trends

What holds you back from achieving your business goals? How can you adapt to new market changes on the fly, in sync with the entire business? Here are some success stories accomplished through key capabilities delivered by Board:

Integrated planning and simulation

A global bank, present in over 60 countries, has adopted the Board planning platform to house solutions that allows key stakeholders to understand the impacts of different decisions by creating multiple versions and what-if analyses in scenarios of stress. Another UK bank has integrated data from multiple sources to pursue financial and operational planning, making more value-adding reporting and analyses available to key decision-makers. Furthermore, Board delivered a top-down planning model enabling senior decision-makers to scenario-model the impacts of key decisions on their business.

Other organisations are pursuing agile scenario planning to navigate uncertainties and regulatory changes as they happen. Driver-based planning delivers scenarios based on key drivers and highlights their impact on capital and liquidity positions. This capability is particularly useful for regulatory requirements such as ICAAP (Internal Capital Adequacy Assessment Process) and ILAAP (Internal Liquidity Adequacy Assessment Process).

Enhanced data reliability and scalability

A British pension provider has overcome Excel-based planning constraints with Board to achieve accuracy, data control and process efficiency while enabling on-demand analysis and reporting. The provider built a scenario-based planning model, reducing planning time by 50 per cent, streamlining consolidation of cost centres and general ledgers, improving internal governance and enhancing forecasting accuracy for headcount and revenue data. Having a single version of the truth eliminates discrepancies and ensures all stakeholders work with the same data. Increased automation and scalability of processes also allow financial organisations to grow without compromising data integrity.

Advanced analytics and real-time collaboration

A European banking group has built a robust platform for analysis, planning and control, giving the business the agility to monitor its ever-evolving position. It has digitally transformed numerous processes to become a data-driven organisation that empowers users with self-service access to the information they need, driving greater visibility of performance across the group and aligning financial budgeting and forecasting with the sales network. Board allows for real-time simulations and what-if analyses to evaluate the impact of different scenarios on financial metrics and regulatory compliance. Workflow management, alerts and reminders facilitate real-time collaboration, ensuring teams stay aligned and informed.

Machine learning and AI integration

Board incorporates machine learning and AI tools to enhance data analysis and decision-making. The platform supports complex calculations and data transformations, providing deeper insights and more accurate forecasts. APIs and machine learning models are integrated to predict trends and optimise planning processes.

Solutions built with the end user in mind

But what determines the difference between one solution and another if they deliver the same capabilities? In our 30-year experience at Board, our customers have told us they value:

- A unified user interface: A seamless and intuitive user interface facilitates planning, process management and decision-making. This ensures a consistent and engaging user experience, reducing the learning curve and boosting productivity.

- Empowerment through self-service: End-users are empowered with self-service capabilities, reducing dependency on IT and enabling users to create their own reports and dashboards. This enhances agility and reduces the total cost of ownership and maintenance costs.

- Scalable and flexible architecture: The platform is designed to grow with your organisation, from storing data to interfacing with external systems as you expand.

Finance managers must navigate uncertainties, meet regulatory requirements and drive strategic growth. The ability to make informed, agile and strategic decisions is paramount. Through its integrated platform, Board offers financial services organisations the tools they need to break down information silos, enhance data reliability and streamline processes by leveraging advanced analytics, real-time collaboration and machine learning. Staying ahead of the curve is no longer a luxury but a necessity.

For more information, visit board.com

Business Reporter Team

Related Articles

Most Viewed

23-29 Hendon Lane, London, N3 1RT

23-29 Hendon Lane, London, N3 1RT

020 8349 4363

© 2024, Lyonsdown Limited. Business Reporter® is a registered trademark of Lyonsdown Ltd. VAT registration number: 830519543